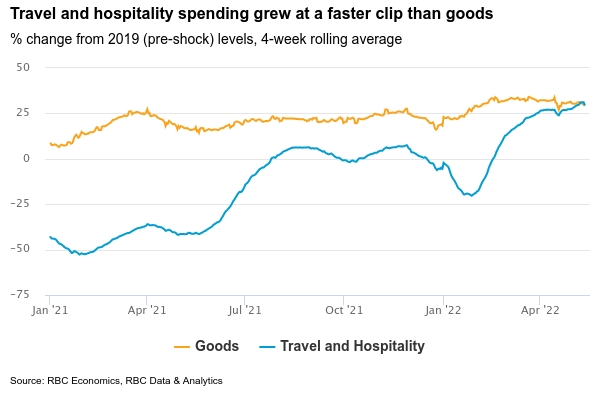

Travel is coming back, hot. Warmer weather, receding COVID-related health concerns, pent-up demand and a stockpile of household savings are all driving a rebound in tourism and hospitality spending. Indeed, our latest card tracker showed that, for the first time, the recovery in spending on services (including airfares, lodging, and dining) overtook spending on physical merchandise. That’s not to say that spending on goods is slowing—StatCan’s preliminary estimate of March retail sales showed a 1.4% increase. The preliminary numbers for April expected next week should look a little softer but will still look strong relative to pre-pandemic levels. Unit auto sales declined in April.

When it comes to goods producing industries, production capacity limits, including global supply chain disruptions and labour shortages, will continue to hamper growth. Auto production has looked stronger over March and April. But manufacturing sales volumes overall were unchanged in March, with higher prices accounting for all of the 2.5% nominal increase. Sales are expected to have ticked higher again in April with price increases offsetting lower hours worked. Headwinds tied to the Russia-Ukraine war and stringent lockdowns in China will continue and labour shortages will pose a more structural long-run challenge that is not easily or quickly addressed. We continue to expect overall GDP growth to slow more substantially once the ongoing bounce-back in travel and leisure spending has run its course.

Week ahead data watch:

- Next week’s SEPH job market data is expected to show still elevated levels of labour demand in March versus available supply. Indeed job postings were close to 70% above February 2020 in March and we expect job vacancy rates in the SEPH data will also remain well-above pre-pandemic levels.

- US personal consumption expenditures are expected to have increased in April given a 0.9% increase in retail sales and higher auto sales already reported.