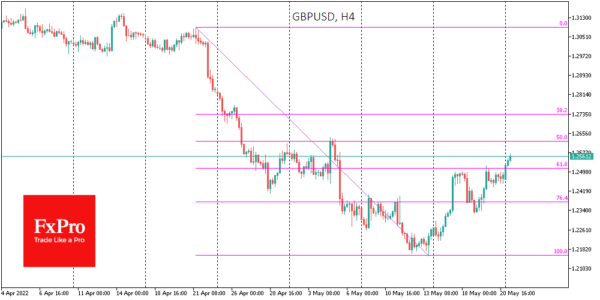

GBPUSD is trading near 1.2560, having added 3.3% to the monthly lows of May 13. We see a smooth recovery in the Pound from those lows, which is also in line with some easing of risk pull in global markets.

The 0.65% strengthening of GBPUSD on Monday morning looks like a signal that the recovery in risk demand has moved from a corrective bounce after oversold levels but is getting on a more serious track, bringing the pair back to the levels of the beginning of the month.

Interestingly, the Pound is giving even stronger signals of risk demand recovery than Bitcoin or the US stock indices, where we saw new multi-month lows inside on Friday afternoon.

The performance of GBPUSD as one of the most liquid yet risk-sensitive currency pairs points to a return of buyers that has gone further than a formal oversold correction after a three-week-long sell-off.

The currency market often acts as a leading indicator of a reversal of established trends, and we are likely to see one such signal from the British currency. A recovery in risk demand in the markets and GBPUSD reaching 1.2750 as early as this week could be an additional confirmation signal that forex was the first to recover from the bearish pressure.

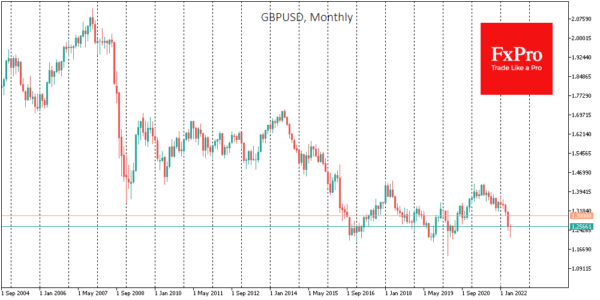

However, it won’t be possible to fully say that markets have digested the crisis of recent months until the GBPUSD consolidates above 1.3000, a level that has become the informal line separating the most acute periods of market fear from attempts to recover to normalcy over the past six years.