The US dollar has been trading like a rocket lately, crushing every other major currency as recession concerns pushed investors into the safety of the reserve currency. The latest inflation numbers at 12:30 GMT Wednesday and retail sales on Friday will be crucial in determining whether this trend still has some miles left in the tank as euro/dollar battles with parity.

All weather currency

A unique dynamic has been playing out over the past few months – all news has been good news for the US dollar. Either economic data is strong and traders become more confident the Fed will raise interest rates at a faster clip to control inflation, or disappointing data magnifies recession concerns and the reserve currency attracts safe-haven flows.

Either way, the dollar tends to benefit. This is also because there is no alternative, as every other major currency is wrestling with its own problems. The euro has been smothered by the energy crisis, the Bank of Japan’s refusal to consider higher rates has wrecked the yen, while abysmal risk sentiment has left its marks on sterling and commodity currencies.

One of the few elements that can change this ‘strong dollar’ dynamic is a serious slowdown in inflation that lessens the pressure on the Fed to hike rates ferociously, elevating the importance of the upcoming data.

Inflation and retail sales

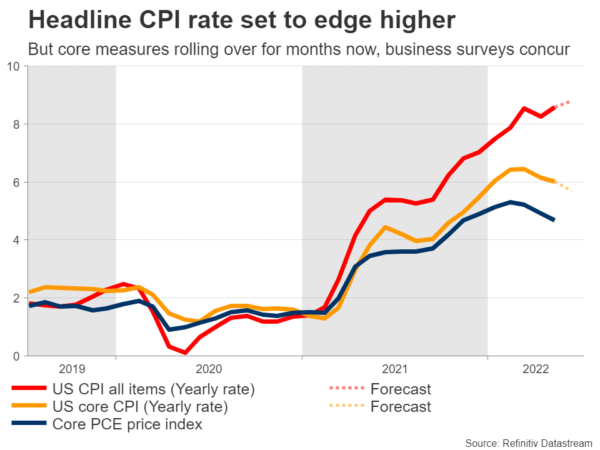

The show will get started with CPI inflation stats on Wednesday. The forecast is for the monthly rate to clock in at 1.1%, an acceleration from the 1.0% in May. This would propel the yearly rate higher to 8.8%, from 8.6% previously.

That said, some signs suggest inflation has started to lose its punch. For instance, the S&P Global PMI survey reported that service sector companies raised their selling prices at the softest pace since last September because demand has started to falter. Similarly, used car prices and various commodity prices have started to roll over.

This would suggest that the risks surrounding the inflation report are tilted toward a slight disappointment, although the catch is that it might be too soon for the retreat in commodity prices to have a meaningful impact on inflation. It will probably be more visible next month.

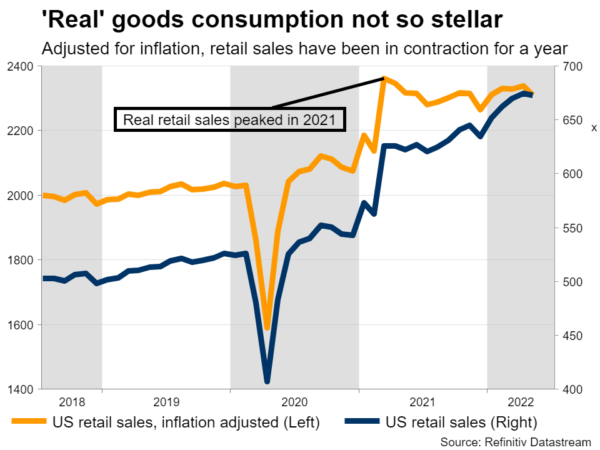

Then on Friday, retail sales for June will hit the markets. Expectations are for a rebound in monthly terms, although it is the yearly rate that tells the story. It currently stands at 8.1%, below the inflation rate, showing that real consumption of goods has essentially been stagnant.

What’s next

In the markets, any disappointment in the upcoming data would likely lead to some profit-taking in the dollar. Taking a technical look at euro/dollar, there is not much resistance until the 1.0350 zone, which is quite far from current prices. Perhaps 1.0180 might come into play before that – an area that is more visible on the four-hour chart.

In the bigger picture, it’s difficult to envision any trend reversal in the dollar until the situation in the rest of the world begins to improve. For instance, if some more energy production comes back online, that would lessen the pressure on the euro and yen. Some good news from Ukraine could have the same effect.

A persistent slowdown in US inflation might also do the trick, although the reason why inflation drops will also matter for the dollar. If inflation is cooling because demand is falling apart and markets are panicking about recession, safe haven demand could continue to support the reserve currency even if some Fed hikes are priced out.

What is needed is a supply-driven improvement in inflation, before the dollar can really retreat. That’s not on the radar yet, which suggests the rally might still have legs. A decisive move below the parity level in euro/dollar could signal a resumption of the trend, opening the door towards the 0.9860 region.