Summary

- The Eurozone economy proved pleasantly—and surprisingly—resilient in Q2, with the initial estimate showing the region’s GDP grew by 0.7% quarter-over-quarter. Not only was that firmer than the consensus forecast for a 0.2% gain, it was also a modest improvement from the 0.5% gain seen in Q1.

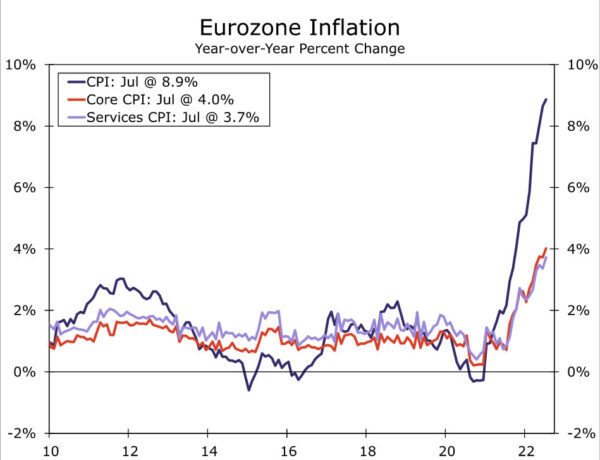

- The Eurozone July CPI was also released, and showed a further acceleration of inflation across the region. Headline CPI inflation quickened to 8.9% year-over-year, the fastest pace on record. The quickening in inflation was driven by higher food prices, and also reflected broader price gains, as the core CPI quickened to 4.0% and the services CPI quickened to 3.7%

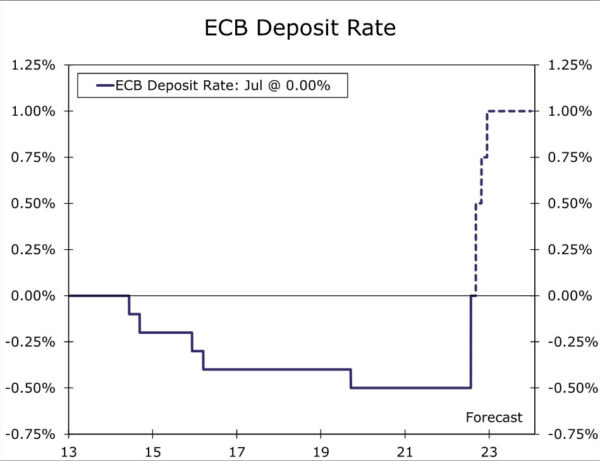

- We view the Eurozone Q2 GDP figures as resilient enough, and July inflation figures as worrisome enough, to reinforce the case for another 50 bps Deposit Rate increase from the European Central Bank (ECB) in September, even with some concerns about the longer-term economic outlook for the region.

Eurozone Economy Resilient in the Second Quarter

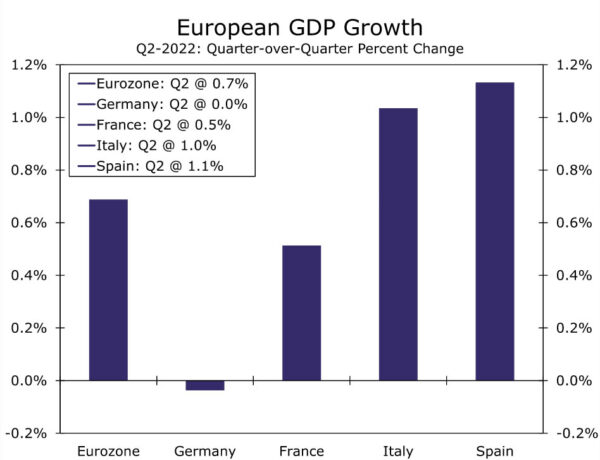

The Eurozone economy proved pleasantly—and surprisingly—resilient in Q2, with the initial estimate showing the region’s GDP grew by 0.7% quarter-over-quarter. Not only was GDP firmer than the consensus forecast for a 0.2% gain, it was also a modest improvement from the 0.5% gain seen in Q1. GDP growth did slow on a year-over-year basis, albeit less than expected, to 4.0%. Looking at quarterly GDP growth for some of the region’s largest economies, France (0.5%), Italy (1.0%) and Spain (1.1%) all enjoyed decent gains. In fact, it was the zero GDP growth for the quarter in Germany that prevented growth for the overall Eurozone region from being even stronger.

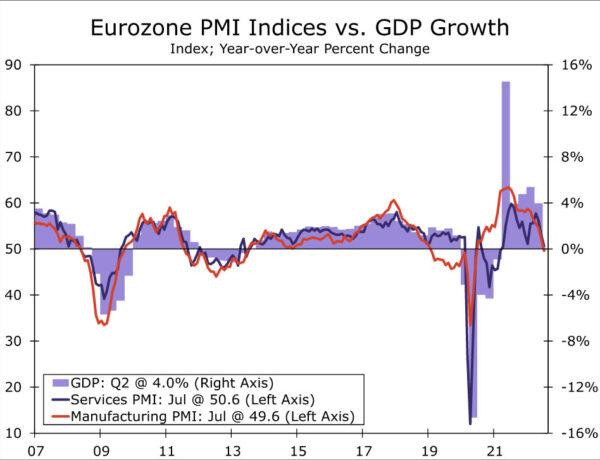

Of course, Germany is one of the Eurozone region’s economies that is most susceptible to a disruption in energy imports from Russia, and thus could see economic activity weaken even further in the quarters ahead. Germany’s IFO business confidence fell to 88.6 in July from 92.2 in June, while the expectations component fell to 80.3, both outcomes that could be portending a German recession in the months and quarters ahead. More generally for the Eurozone, confidence surveys and leading indicators are consistent with a slower pace of growth from the second half of this year, as the Eurozone July manufacturing and service sector PMIs both fell noticeably to 49.6 and 50.6 respectively. A combination of high energy prices that should increasingly weigh on spending, energy supply disruptions that could more directly impact production and growth, and a likely U.S. recession, all still have the potential to push the Eurozone economy into recession by early next year, despite the encouraging second quarter result.

Inflation Still Rising Early in the Third Quarter

The GDP figures were not the only key piece of economic news from the Eurozone. The Eurozone July CPI was also released, and showed a further acceleration of inflation across the region. Headline CPI inflation quickened to 8.9% year-over-year, the fastest pace on record. For the latest month, energy price inflation actually softened a bit, showing a gain of 39.7%. Instead, the quickening in inflation was driven by higher food prices, and also reflected broader price gains, as the core CPI quickened to 4.0% and the services CPI quickened to 3.7%. Indeed, our estimates suggest that on seasonally adjusted basis, core CPI inflation is running at an annualized rate of close to 4% over the past three months as well as the past six months, suggesting that underlying inflation pressures likely remain uncomfortably high for European Central Bank policymakers.

When the European Central Bank kicked off its rate hike cycle in July with a 50 bps Deposit Rate increase, it said the front loading of its exit from negative interest rates would allow it to transition to a meeting-by-meeting approach to interest rate decisions. In that context, we believe today’s data offers some guidance and insight into the probable outcome of the European Central Bank’s September monetary policy meeting. We view the Eurozone Q2 GDP figures as resilient enough, and July inflation figures as worrisome enough, to reinforce the case for another 50 bps Deposit Rate increase in September, even with some concerns about the longer-term economic outlook for the region. While the prospect of another 50 bps rate increase along with the relative resilience (for now) of the Eurozone economy compared to the U.S. economy could possibly offer brief support for the euro, we still expect a weaker EUR/USD exchange rate over time. Indeed, we forecast the EUR/USD exchange rate to fall to $0.9600 (or below) over the medium-term.