Faced with stubbornly low inflation, the Bank of Japan is now among the few central banks not tightening policy. There is little appetite for any strategy changes when the BoJ meets on Thursday and even if the government resorts to FX intervention, it won’t be enough to turn the tide in the sinking yen. Of course, some caution is still warranted as ‘short yen’ is already a crowded trade.

Lowflation

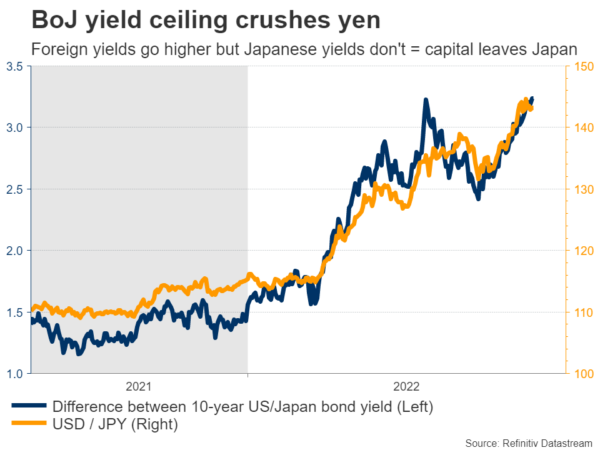

It has been a devastating year for the yen, which has lost almost 25% of its value against the US dollar. With central banks across the world raising interest rates at an incredible pace to vanquish inflation but the Bank of Japan refusing to play this game, rate differentials have widened, crushing the yen as capital flows out of the country in search of higher returns abroad.

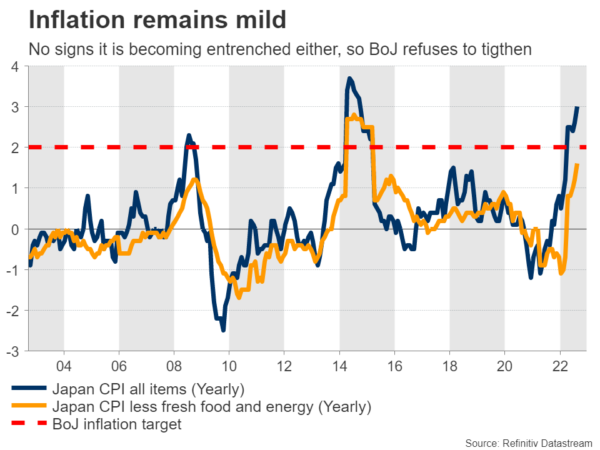

The reason the BoJ is so reluctant to tighten policy is that inflation in Japan is mild. Excluding food and energy, inflation is running at 1.6%, in contrast to the sky-high prints in other developed economies. Wage growth and inflation expectations remain suppressed too, dispelling the notion that inflation will be persistent.

As such, the BoJ argues this inflationary wave is simply the product of a global supply shock. Without it, Japan might still be trapped in deflation, so there is no reason to withdraw the stimulus that has ravaged the yen. In fact, Governor Kuroda recently said that even if the BoJ raised rates a little, it still wouldn’t stop the yen’s bleeding.

No (real) changes

At this meeting, the BoJ is unlikely to roll out any meaningful policy changes. Most officials have been adamant that inflation dynamics are too muted, forcing them to keep their foot heavy on the accelerator.

That means keeping in place the ceiling on longer-dated Japanese yields, which is the strategy responsible for the yen’s suffering. Since the BoJ prevents domestic yields from rising beyond a certain level, interest rate differentials automatically widen against the yen as foreign central banks raise rates.

This policy has to be scrapped before the yen can make a real comeback, as that would enable Japanese yields to play catch-up with their global counterparts. However, since this meeting doesn’t even include updated inflation forecasts, it would be strange for the BoJ to take such drastic measures.

Instead, some reports suggest the only change this time might be a rollback of the emergency schemes the BoJ introduced during the pandemic, to provide funding to smaller businesses impacted by lockdowns. The market didn’t care much for these measures back then, and is unlikely to do so now.

Crowded trade

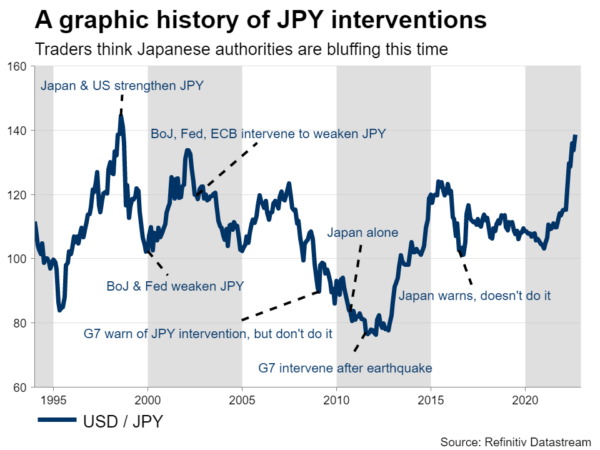

Threats of FX intervention to shore up the yen from Japanese authorities have fallen on deaf ears, mostly because market participants think they are bluffing. Solo intervention would cost a ton of FX reserves to execute, it has a low probability of success, and could backfire by inviting more speculators if it does fail.

Hence, it’s a gamble the government doesn’t really want to take. It might still pull the trigger in case the yen’s freefall becomes too extreme, and that could flush out some speculators, but it wouldn’t have a lasting impact beyond the psychological shock-and-awe.

With the BoJ refusing to play ball and the government unable to turn the tide, it is hard to envision any trend reversal in the yen, especially while foreign central banks continue to raise rates so rapidly. That said, shorting the yen into the ground on rate divergence is already a very crowded trade, which can lead to violent corrections.

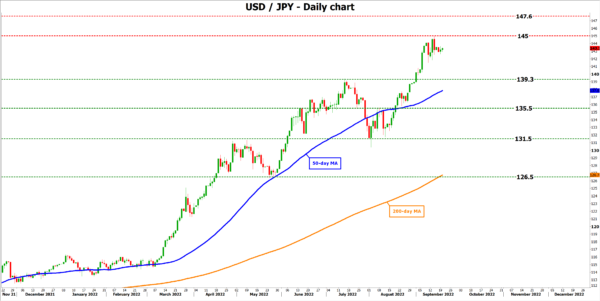

This makes the yen difficult to trade in either direction. The outlook remains negative but it has already depreciated quite dramatically. Looking at the charts, dollar/yen could fall all the way to 139.30 before it even touches its previous high.

On the upside, a break above the 145 region would signal a resumption of the uptrend, turning the spotlight towards 147.60, which was the reversal point a quarter century ago.