Strong data, Fed comments pushing USD higher

The US dollar is trading near seven week highs as economic data has been solid, the central bank is still pushing for a third rate hike and the tax reform proposal is moving forward. Leading manufacturing and non manufacturing indicators have improved and rising exports have shrunk the trade deficit to a yearly low but questions remain on the effect the tropical storms will have on the biggest economic indicator in the market.

The U.S. Bureau of Labor Statistics will release the non farm payrolls (NFP) report on Friday, October 6 at 8:30 am EDT. The economy is forecasted to have added 82,000 positions in September. The impact of hurricanes Harvey and Irma is to blame for the underperformance but given the resilience of the economy the possibility of the final figure beating expectations is not far fetched.

The ADP private payrolls report came in close to the forecast with 135,000 jobs and unemployment claims rose by 260,000 when a 266,000 gain was anticipated. Fed FOMC voting members were in full force this week and today’s comments from Philadelphia Fed chief Patrick Harker that while the 2 percent inflation target will remain untouched he still believes there should be another rate hike. The CME FedWatch tool shows a 86.7 percent probability of the interest rate moving higher to a 125 to 150 basis points range.

The EUR/USD fell 0.45 percent on Thursday. The single currency is trading at 1.17050 in a tight range awaiting the release of the September U.S. non farm payrolls (NFP) report. The US dollar has traded higher versus the euro as the US economy has shown resilience after two hurricanes.

The release of the European Central Bank (ECB) monetary policy meeting minutes showed there is still an ongoing debate on how exactly to pull back stimulus. Fearing a taper tantrum ECB policy makers are still discussing the size of the taper and a mix of extending the duration. There is even the possibility of changing the name of the process to recalibration to avoid the negative connotation of a tapering.

The situation in Catalonia is far from resolved and Separatists will meet on Monday defying a Spanish court order, but the market has been alerted that they will not declare independence.

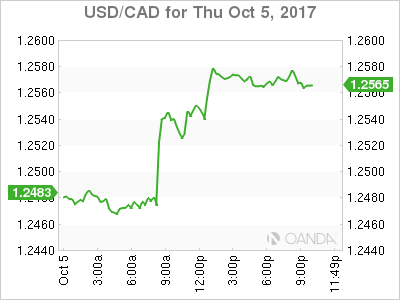

The USD/CAD gained 0.74 percent in the last 24 hours. The currency pair is trading at 1.25688 after trade data in the US surprised to the upside with rising exports while a different story played out in Canadian figures. The Canadian trade deficit widened in August with exports falling for a third month in a row.

Economists have warned that the Canadian economy is cooling down after an impressive first half of 2017. Two rate hikes and impressive growth took the loonie to appreciate versus a struggling USD. A third rate hike is losing ground in the eyes of the market. The Bank of Canada (BoC) cut rates by 50 basis points in 2015 and it wasn’t until their assessment of the economy improved in 2017 that they have hiked twice to leave the benchmark rate at 1.00 percent.

Tomorrow’s job releases in Canada and the US will be telling on how the two economies are acting in tandem or breaking apart. The tropical storms in the US could obfuscate the jobs situation in the US while in Canada there are growing concerns about the rate of full time job losses. The headline number in Canada has been steady, but thanks to part time positions. Jobs in Canada are expected to have gained 13,900 positions in September.

Market events to watch this week:

Friday, October 6

8:30 am CAD Employment Change

8:30 am CAD Unemployment Rate

8:30 am USD Average Hourly Earnings m/m

8:30 am USD Non-Farm Employment Change

8:30 am USD Unemployment Rate