Following the slowdown in the euro area inflation during the month of November, investors changed their minds with regards to whether another triple hike is needed by the ECB, with hopes of a peak in sky-high prices allowing them to conclude that a 50bps increment may be more appropriate. The ECB meets on Thursday at 13:15 GMT, and it remains to be seen whether investors are right or wrong. A bigger question though may be what kind of signals officials will offer with regards to their future plans, and how the euro may react.

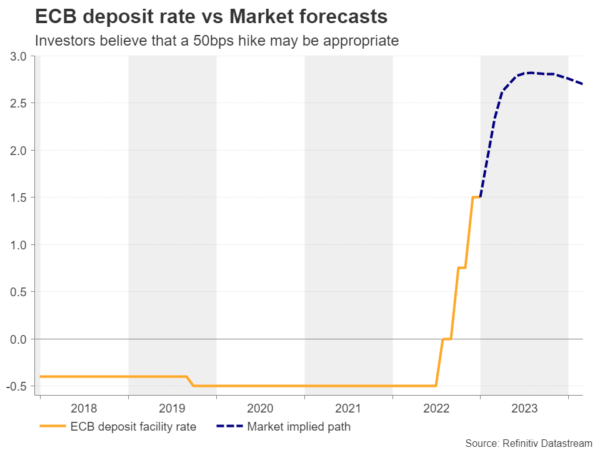

Investors believe that a 50bps hike may be appropriate

Since deciding to begin its tightening crusade in July, the ECB has been raising interest rates at its fastest pace on record, already adding 200 basis points to its key deposit rate. At its latest gathering, the Bank delivered its second 75bps hike, with the minutes of that meeting revealing that policymakers were anxious about inflation becoming entrenched.

However, according to preliminary data, inflation slowed by more than expected in November, with the headline rate of the harmonized index of consumer prices sliding to 10.0% y/y from 10.6%. This offered a degree of relief to investors, who scaled back bets of a third triple hike and became more convinced that a 50bps increment may be appropriate. That said, according to money markets, there is a decent 30% chance of another triple hike, which means that not all participants believe that a slowdown is appropriate. According to a Reuters poll, 7 out of 60 economists surveyed also believe that a more aggressive action is warranted.

Spotlight to fall on accompanying language

Ergo, a 50bps hike may come as a disappointment to those expecting a bolder move and the euro may slide on such a decision. That said, any hike-related retreat may remain limited and short-lived, as a half-point hike is the base case scenario. Traders are likely to quickly turn their attention to the accompanying statement for clues and hints with regards to the Bank’s future course of action. Although the updated macroeconomic projections are a downside risk for the euro, as they could point to a recession in 2023, a hawkish message and even a split Council with some members favoring a larger hike could eventually prove supportive for the euro.

Ahead of the November inflation data, ECB President Christine Lagarde said that inflation has not peaked, while chief economist Philip Lane more recently said that they will have to raise rates several more times, even if inflation is now close to its peak, remarks which add some credence to the hawkish case.

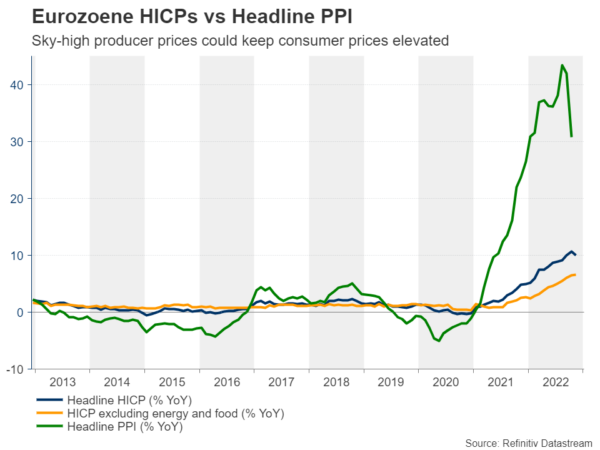

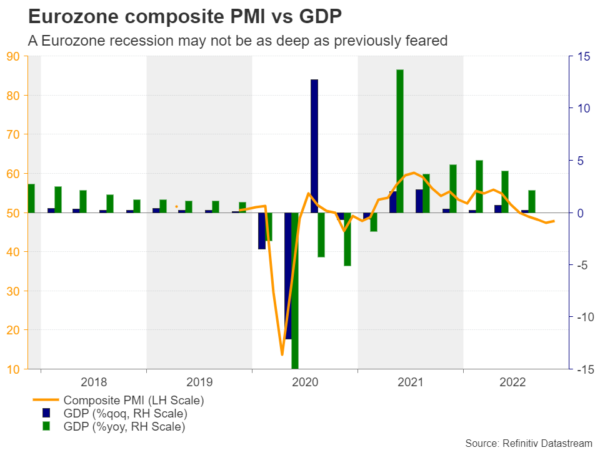

Economic releases permit a hawkish tone

After all, headline inflation remains in double digits, core inflation has yet to show signs of topping, while the headline PPI rate, despite a deep slowdown during last month, remains at unparalleled levels (around 30%). Surging producer prices could well be channeled into consumer prices in coming months, which doesn’t allow room for complacency. On top of that, the S&P Global composite PMI pointed to another month of contraction in November, but it rose instead of sliding like it was initially forecast. Yes, a recession in the euro area seems inevitable, and the ECB’s forecasts may well confirm that, but the PMIs may have added to hopes that the wounds may not be as deep as feared a couple of months ago, thereby giving another reason to policymakers for signaling that this fight against inflation is not over yet.

This tilts the risks surrounding the reaction of the euro to the upside, even in the case of a 50bps hike. For the euro to stay wounded in the aftermath, the statement and President Lagarde may have to signal and highlight that inflation has already peaked, which according to the aforementioned data doesn’t seem a likely scenario.

Euro/dollar awaits not only the ECB, but the Fed as well

However, how the euro will perform against its US counterpart may also depend on the outcome of the FOMC decision just the day before. So, for the common currency to perform well against the greenback in case ECB officials appear in their hawkish suits, the Fed decision may need to have a dovish flavor. A median dot for 2023 below the terminal rate projected by the market could perhaps do the trick. Of course, if the ECB pushes the triple-hike button for a third consecutive time, the euro is likely to shoot higher without caring what the Fed has done.

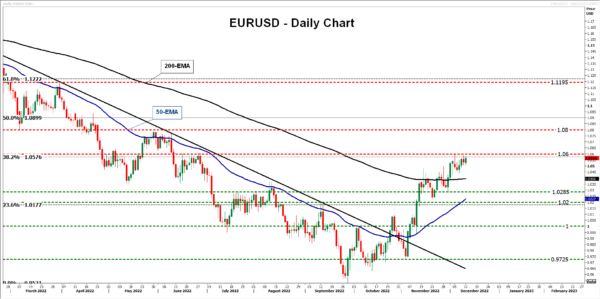

From a technical standpoint, euro/dollar has been struggling to break above the 1.0600 zone, which offered strong resistance back in June and also coincides with the 38.2% Fibonacci retracement level of the May 2021 – September 2022 downtrend. A dovish Fed and/or a hawkish ECB could result in the break above that obstacle, a move that could see scope for upside extensions towards the 1.0800 territory, marked by the high of May 30.

Now, in the less likely case of ECB policymakers signaling that euro area inflation has already peaked, the pair may pull back and perhaps test the support zone of 1.0285, marked by the low of November 30, or the 1.0200 area, defined as support by the inside swing high of September 12.