After Wednesday’s US inflation numbers added credence to the view that the Fed may be forced to cut interest rates later this year, the next focal data set may be the US retail sales for April, due to be released on Tuesday. Industrial production for March, as well as some housing data for the month of April are also in next week’s calendar. Will all these releases help alleviate worries over a potential recession? How will they affect Fed policy expectations and how may the dollar respond?

Fed cut bets remain firmly on the table

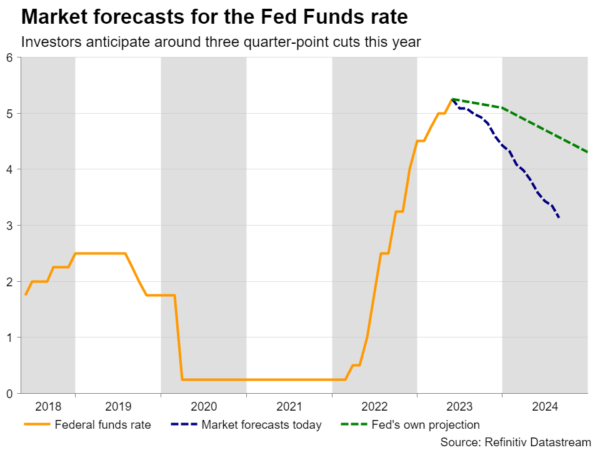

Despite not closing the door to a June hike when they last met, Fed officials watered down their forward guidance, noting that whether further hikes are needed will largely depend on incoming data. This allowed market participants to place bets that the Committee will step to the sidelines when it meets next.

On top of that, Wednesday’s inflation data revealed that the headline CPI rate ticked down to 4.9% year-over-year from 5.0%, with the core measure holding steady at 5.5% y/y, which combined with the jump in initial jobless claims to a one-and-a-half-year high added to investors’ stubborn view that the Fed may be forced to push the cut button after the summer, despite policymakers repeatedly saying that no cuts are warranted for this year.

Retail sales expected to rebound

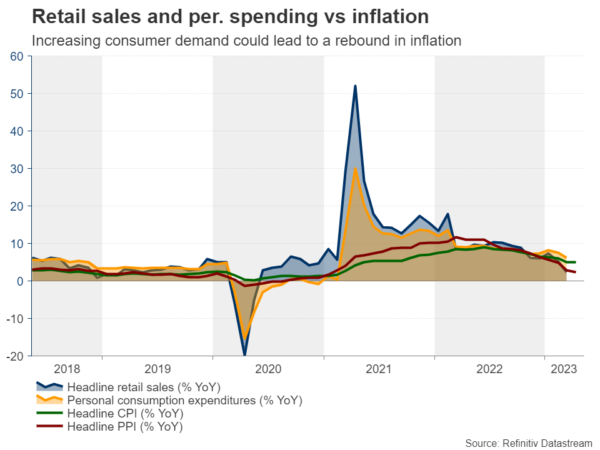

Now, the next highlight may be the US retail sales for April. Expectations are for both the headline and core month-over-month rates to have rebounded to 0.7% and 0.5% respectively from -0.6% and -0.4%.

Following the overall healthy jobs report for the month and the Fed’s loan survey that eased fears of a credit crunch, a rebound in retail sales could somewhat reduce recession concerns and allow market participants to scale back some basis points worth of rate reductions. What’s more, improving consumer demand could lead to a rebound in consumer prices in the months to come and lower interest rates may not be the recipe should this happen.

Housing market shows signs of stabilization

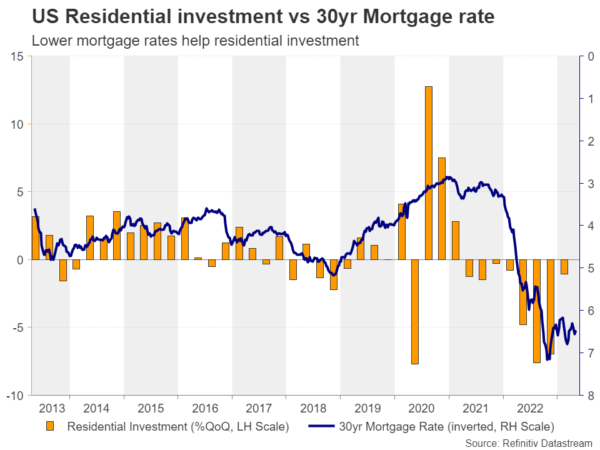

Housing data may be closely watched too by those trying to assess the health of the US economy. On Wednesday, building permits are expected to have fractionally increased and housing starts to have slightly declined, while on Thursday, existing home sales are seen declining 2% month-on-month.

The Fed’s aggressive tightening has pushed the housing market into recession, with residential investment contracting for eight quarters in a row but lately, there have been some signs of stabilization, perhaps as mortgage rates have come off their highs. Thus, further improvement could revive optimism but also add to expectations that inflation may prove stickier than previously thought.

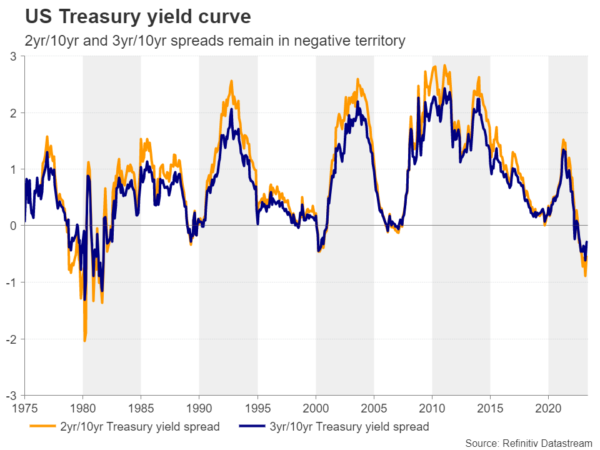

Yield curve remains inverted

Although rebounding from their lowest levels since 1981, the 2yr/10yr and 3yr/10yr Treasury yield spreads remain in negative territory, pointing to a still-inverted yield curve. This and the bets of around 75bps worth of rate cuts by December suggest that investors are still concerned about the performance of the economy and just a week’s releases may not be enough to dispel their worries. The stalemate in the US Congress over the debt ceiling may be one of the reasons that they are holding back, as a government shutdown may well have adverse effects on the economy.

Dollar could gain, but reversal remains premature

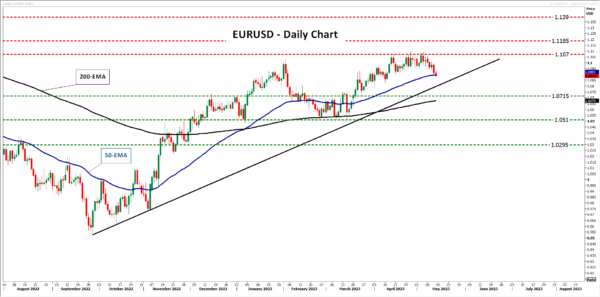

Therefore, even if the dollar strengthens next week, it will still be premature to call for a bullish reversal. Should the market reduce its expected Fed rate cuts to 50bps from 75bps, there will still be divergence between the ECB and the Fed, as the former is expected to deliver nearly another 50bps worth of rate hikes. Thus, the euro/dollar uptrend may stay intact for a while longer.

The latest retreat continues for a while longer, but the bulls may be tempted to re-enter the battlefield from near the uptrend line drawn from the low of September 28. A potential rebound from there may challenge the too-hard-to-break barrier of 1.1070. A breach of that ceiling may be needed to signal a trend continuation, with the next stop perhaps being the peak of March 31, 2022, at 1.1185.

For the outlook to turn bearish, a break below 1.0715 may be required. The price would be below the aforementioned uptrend line and may travel towards the 1.0510 area, which offered strong support in late February and early March this year.