Market picture

Crypto market capitalisation has adjusted 0.65% in the past 24 hours to 1.17 trillion, remaining near the highs since early May. The correction is primarily due to a 0.55% dollar strengthening over the same period. The current dynamic is still a halt after a 16% rally but not a correction.

Bitcoin is frozen at $30K, a significant technical level. These levels were pivotal for the first cryptocurrency in April, and last May it took more than a month for the bears to sell the rate lower. Also, a furious part of the crypto rally started from this level in early 2021. It’s worth being prepared for quite a long consolidation, but this week’s bullish breakout suggests that long-term investors have already moved to accumulate Bitcoin on drawdowns.

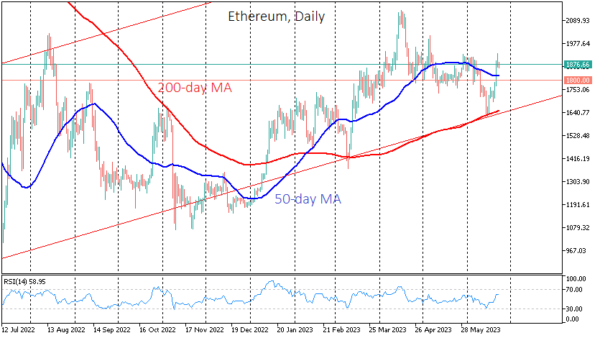

Ethereum’s dynamics are settling into a general uptrend channel with buying on downturns, roughly repeating the dynamics we’ve seen for 2019 and 2020. It could take months before a FOMO rally.

News background

Gemini cryptocurrency exchange co-founder Cameron Winklevoss announced a new phase of bitcoin hoarding. He says, “Anyone watching the flow of ETF bids understands that now is a good time to buy BTC before the ETFs hit the market.

Eight founder Michael van de Poppe sees $28.5K as an excellent level to buy before Bitcoin moves towards $40K. He noted that the BTC dominance index is approaching meaningful resistance, which should lead to Bitcoin consolidation and a shift in market attention to altcoins.

Valkyrie Investments has applied to the SEC to launch an exchange-traded fund (ETF) based on the Bitcoin spot price. BlackRock, WisdomTree, Invesco and Bitwise had also previously applied to establish a spot bitcoin ETF.

Singapore has approved a digital token licence for Ripple, allowing the company to expand its platform for cross-border payments in XRP.