It is probably the most important week yet this year as the ECB, the Fed and the BoJ are holding their last rate-setting meetings before the summer lull. The market is confident for another 25bps hike from the ECB but what about September? Also, could Thursday’s meeting act as a tailwind for the euro against the pound, the best performing currency of 2023?

Where are we now?

The ECB Governing council is expected to have a full-on discussion at the 2-day meeting commencing on Wednesday, with the announcements coming at 12:15pm GMT on Thursday and the usual press conference held 30 minutes later. The market is currently pricing in 46bps of rate hikes until the December 2023 meeting. As a comparison, the Fed is seen hiking in July with a small chance (around 30%) of another 25bps increase in November 2023. However, it all goes downhill from there as around 100bps of rate cuts are priced in by November 2024.

The market’s mind is on two issues regarding this week’s ECB gathering. The first one is whether the ECB will confirm the market expectations and announce a 25bps rate hike. President Lagarde essentially pre-announced this move at the June meeting, but the recent economic releases are causing concern. In particular, the business surveys continue to point to an extremely weak growth period, which in the case of Germany could mean the third consecutive quarter with negative growth. Consequently, the ECB doves are becoming much more vocal as they are trying to affect the outcome of this meeting but mostly dictate the discussion for September.

What about the September meeting?

This brings us to the second and more pressing issue for Thursday’s press conference. Will Lagarde repeat the usual “we still have ground to cover” phrase, which has been her motto lately? Up to now, the doves have been accepting a slower asset reduction pace for the various ECB purchase programmes that are currently in place in exchange for rate hikes, but they now seem ready to put up a proper fight. With the next staff projections coming at the September meeting, the doves are desperate to avoid any pre-commitment from Lagarde, even if it is sugar-coated with the usual “data-dependency” watchword.

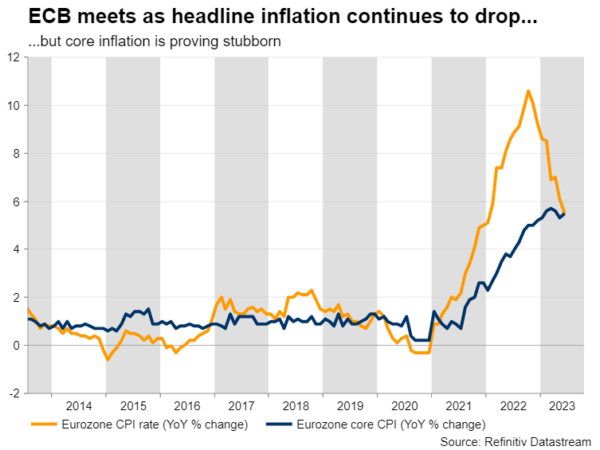

From an economic perspective, the headline inflation rate continues its drop, but the core component is proving very stubborn. Some central bankers have argued against the usefulness of the core indicator in predicting future headline inflation, but Lagarde’s focus on this component at the June press conference means that the ECB is monitoring it very closely. Interestingly, the preliminary German CPI print for July, and the first estimates of GDP growth for the second quarter of 2023 from both France and Spain are scheduled to be released on Friday morning. It is only fair to assume that these figures will be at the ECB members’ disposal during the 2-day gathering.

When chairing the press conferences, Lagarde expresses the majority opinion of the ECB Governing council and hence her comments should reveal the true behind-doors discussion regarding the guidance for the September meeting. She will clearly have to be on top of her game on Thursday so as to please both two sides at the ECB and to avoid displeasing the markets. Fortunately for ECB members, they will have the luxury of watching the Fed press conference on Wednesday evening and evaluating the associated market reaction. And to a certain extent, they may be able to adjust their message to limit the possibility of the market misinterpreting their announcements.

Therefore, a failure by Lagarde to repeat the aforementioned motto would clearly be seen as the key message that the ECB is indeed close or already at its terminal rate, with the market quickly pricing in aggressive rate cuts, even during the fourth quarter of 2023. On the other hand, if Lagarde repeats her motto the market would get excited, but the weakening data releases will probably stop it from behaving exuberantly.

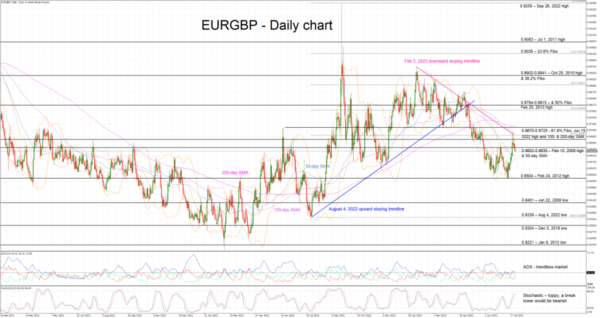

Euro/pound pair below a key trendline

It has been a one-way street move in euro/pound during 2023 with the pair registering a new 2023 low of 0.8503 on July 11. The euro bulls managed to stage a recovery until they found significant resistance at the February 3, 2023 downward sloping trendline. With the overall technical picture in favor of the euro, the next leg rests on the hands of the ECB.

As the market feels strongly about this meeting, there is an increasing scope for disappointment if the ECB does not deliver the 25bps hike and/or Lagarde fails to appear hawkish at the press conference. In this case, disappointment should push euro/pound aggressively lower towards the 0.8500 area. On the flip side, should the press conference prove to be a carbon copy of the June one, the euro bulls would entertain the idea of a move above the busy 0.8670-0.8725 that would challenge the prevailing bearish trend.