- BOC rate hike odds for the October 25th meeting rise from yesterday’s 23.9% to 28.8%

- Hours worked climbed to the highest level since February

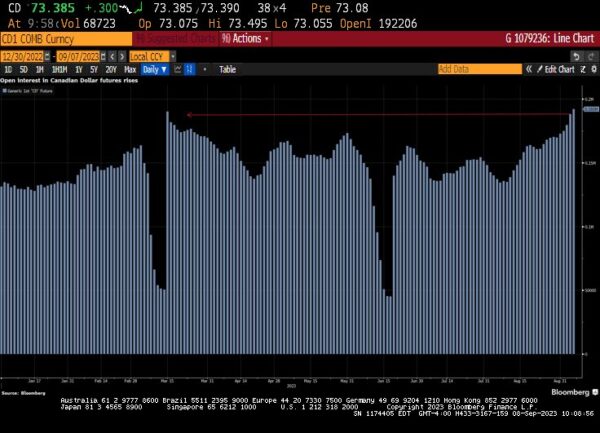

- CAD futures open interest rise to best levels since mid-March

Canada’s economy isn’t quite ready to cool. The latest Canadian employment report showed hiring bounced back in August, doubling expectations. The near 40,000 added jobs exceeded the 17,500 consensus estimate and proved that the prior month’s unexpected shedding of jobs was not the beginning of a new trend. The BOC will pay close attention to the wage growth acceleration of 5.2%, which was expected to soften to 4.7%. There is a lot of data before the October 25th BOC meeting, but it still seems like they’ve reached the terminal rate for this tightening cycle.

Open Interest in Canadian dollar futures

The Canadian dollar is the top performing G10 currency and that could continue given how the futures market is positioned. The last time open interest for Canadian dollar futures were at these levels was the middle of March, which was when USD/CAD started its decline from around the 1.37 level to the 1.3300 area.

Canadian Employment Highlights

Canada’s strong jobs report showed full-time employment rebounded from 1,700 to 32,200, while part-time work created 7,800 jobs, much better-than-the prior month’s decline of 8,100 positions. The unemployment rate held steady at 5.5%, which was better than the expected increase of 5.6%. The majority of the job gains stemmed from the professional and technical services, and construction. The regions that benefited the most were Alberta, British Columbia and Prince Edward Island. Nova Scotia was the only region that lost jobs. While the job gains are a positive sign, when you figure in population growth, this pace won’t cut it for keeping the unemployment rate steady. About 50,000 jobs per month would be needed to support a steady unemployment rate.

USD/CAD 60-minute chart

After breaking down below the 1.3650 level, bearish momentum is slowing down ahead of the 1.3600 level. If the start of next week does not include a risk averse start, the Canadian dollar could have a strong move here. Unless the uptrend line (which started in July) is broken substantially to the downside, the prevailing bullish trend may remain in place.