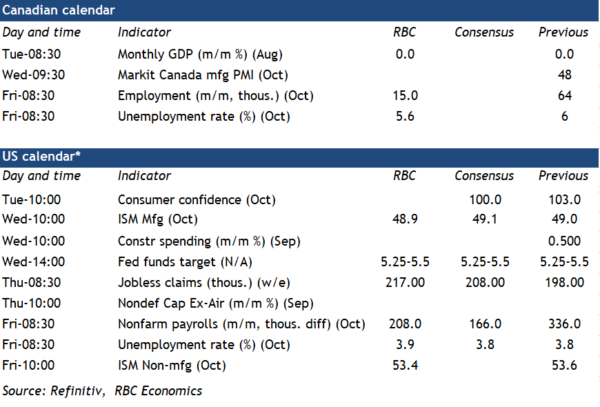

We expect Canadian GDP was unchanged for a second straight month in August (slightly below the preliminary estimate for a 0.1% increase) after dropping 0.2% in June. Wholesale sale volumes increased 0.6% in August, but manufacturing volumes fell 0.7%. Retail sale volumes declined for a third straight month in August (-0.7%) and are tracking more than 2% (annualized) below their Q2 average in Q3 to-date. Our own tracking of card spending also flagged weaknesses in spending on discretionary services like hotels and food services, adding to evidence that consumer spending is wobbling further after coming essentially to a standstill in Q2.

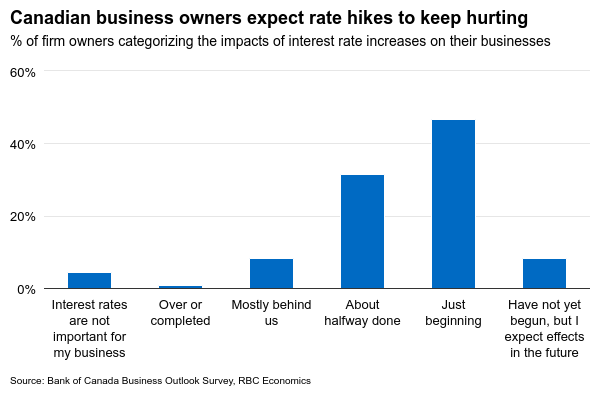

We continue to track a second consecutive quarterly dip in GDP in Q3 after output edged down 0.2% (annualized) in Q2, with those readings both looking substantially softer on a per-capita basis once accounting for surging population growth. And growth headwinds continue to build. More than 45% of businesses in the Bank of Canada’s Q3 Business Outlook Survey felt that the impact of higher interest rates on their businesses has only just begun.

We expect cracks that have begun to show up more clearly in the GDP growth backdrop will also become more evident in labour markets. Employment growth has remained positive in Canada. But with surging population growth boosting available labour supply, the gains have not been strong enough to prevent a half point rise in the unemployment rate since the spring. And labour demand has continued to slow with job openings still drifting lower. We look for another 15k increase in employment in October but alongside a tick higher in the unemployment rate to 5.6%.

Week ahead data watch

In the U.S., economic data has been substantially stronger, and we look for a 208k gain in payroll employment to be reported next week. Still, labour demand has also been slowing under the surface in the U.S. with job openings drifting lower and wage growth slowing. We look for the unemployment rate to tick up to 3.9% (despite higher employment) after climbing to 3.8% over August and September from 3.5% in July.

The U.S. Federal Reserve is widely expected to follow in the steps of the Bank of Canada and hold interest rates unchanged again in October after skipping a hike in September. U.S. economic growth numbers have remained exceptionally resilient, but inflation pressures moderated over the summer and that is allowing the Fed room to be patient as they wait for already high interest rates to slow growth with a lag.