- The inflation target has been met for 22 consecutive months. Price pressures consistently rhymes with 2% annual inflation but the sustainability of that depends on wage increases.

- We think the BoJ is almost ready to hike the interest rate to zero and dismantle yield curve control. However, we see no reason to rush and expect them to stay on hold at the March meeting ending Tuesday, but it is admittedly a close call

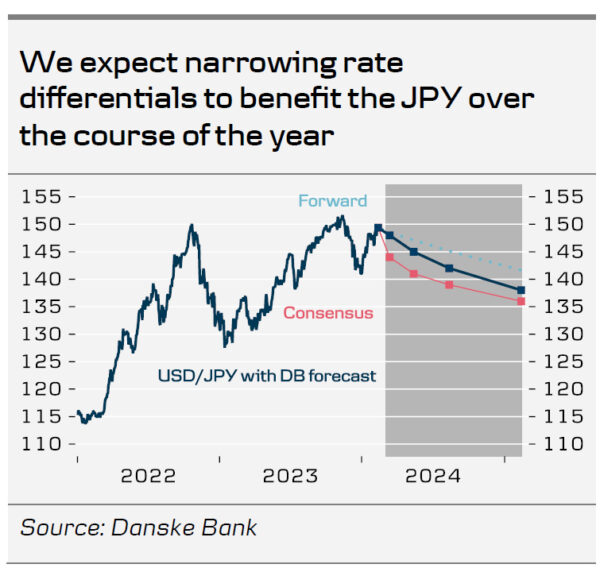

- Whether the BoJ potentially exits NIRP in March or April does not alter our strategic bullish view on the JPY in 2024.

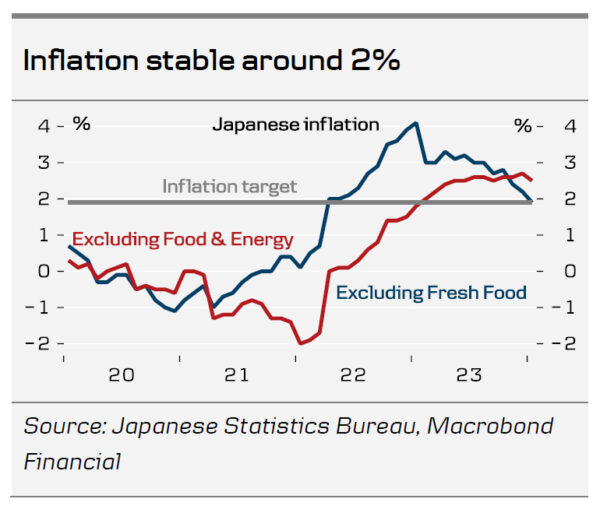

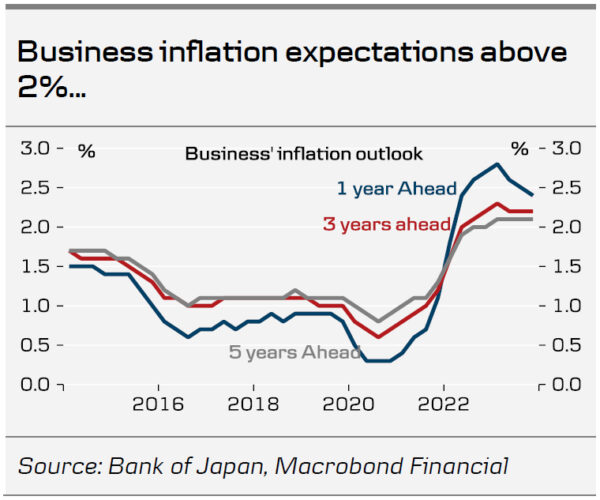

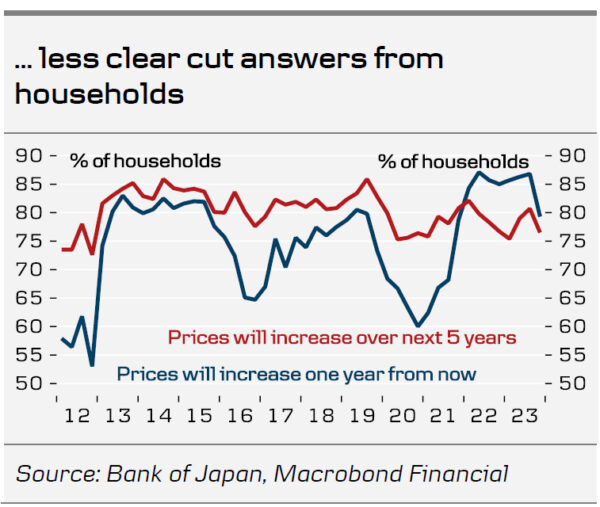

The Bank of Japan (BoJ) has met its 2% inflation target for 22 consecutive months. Their favourite inflation measure, CPI excl. fresh food, has declined steadily and stands at 2% now, as non-fresh food inflation has abated. Core price pressures rhyme with 2% inflation and have done so for a while. Businesses’ inflation expectations have largely stabilised just above 2%. Households are more uncertain about the outlook for prices, though.

With this background, it could seem puzzling why Japan remains the only country in the world with a negative interest rates policy (NIRP). The reason is the absence of any significant wage-price spiral so far, which questions the longevity of Japanese inflation.

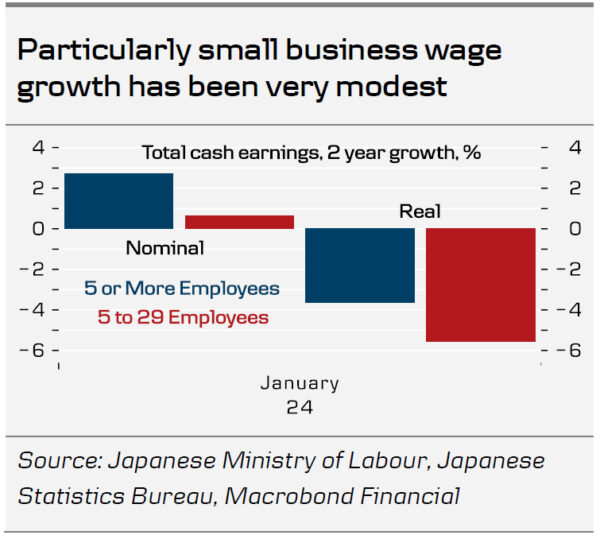

The first tally from this year’s “spring wage offensive” showed that workers at major firms got a 5.28% pay increase, fairly close to the 5.85% they asked for. This is the key reason why we expect BoJ will be ready to hike its policy rate to zero in April. That said, it must remain a concern to the BoJ that wage growth is very weak among smaller businesses. Over the recent two years, wages have increased a modest 2.7% overall but only 0.7% in businesses with 5-29 employees. We will have to wait for at least the third wage tally, released in early April, to know much more about the 70% of Japanese workers who are employed in the SME segment. Only by early July, we will get the final tally and thus the full picture of the spill over to small businesses as well.

Financial markets have priced in close to 5 bps hike for the meeting ending on Tuesday, which implies a significant probability of a hike, although less than 50% as both a 10 and 20 bps hike could be in play. Thus, the March meeting is by all means live. We just do not think the BoJ has any reason to hurry. The window of opportunity to tighten policies has opened further this year as Fed cuts have been priced out of the market and a tightening move from the BoJ is now less in opposition to other global central banks than previously. It would make more sense to wait for incoming wage data ahead of the late-April meeting, which will also hold a new outlook for the economy, including the bank’s first 2026 inflation forecast. By then, the quarterly Tankan report for Q1 will also be released, shedding more light on the state of the economy and businesses’ price behaviour.

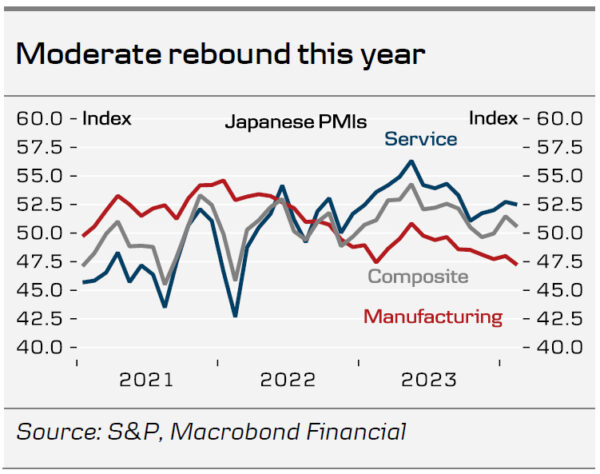

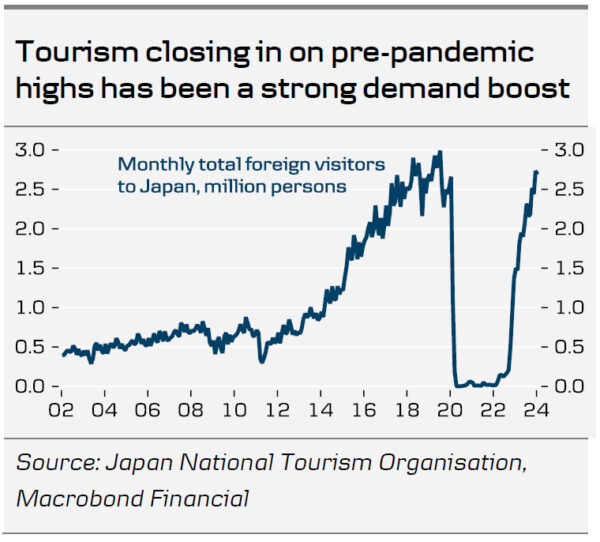

Another reason why the BoJ is perhaps in less of a hurry to exit NIRP is the recent slowdown in economic activity. Japan barely escaped technical recession in 2023H2 as Q4 growth was revised back above zero, by the slimmest possible margin, and indicators for Q1 have looked mixed. The manufacturing slowdown has worsened further, while the service sector looks quite robust, which should be seen in the light of the return of tourism. Japan has 2.7 Mio. visitors every month now, which is closing in on pre-pandemic levels. A 10 bps rate hike would be insignificant in itself, but hiking rates for the first time in 17 years and exiting NIRP will be a strong signal to markets. That is also why, the BoJ might decide to preserve the flexibility in the YCC for now, and perhaps hike rates by 20 bps. Our base case is a 10 bps hike and abolishment of YCC in April, though.

Timing of monetary policy normalization does not affect our positive stance on the JPY

Whether the BoJ potentially exits NIRP and YCC in March or April does not change our strategic bullish view on the JPY in 2024. Note that markets have seen several headlines suggesting a March BoJ move, but nothing from the more trustworthy Nikkei, which the central bank has previously used as a communication outlet.

However, near-term price action in the JPY would naturally be affected by the March meeting. Even if we are right and the BoJ does not make any changes to policy at the March meeting, it is unlikely that it will be a meeting without any notable near-term signals; for example, the BoJ could indicate an April move. We generally think that a potential hold at the March meeting would lean hawkish.

Focus will also be on whether the BoJ will offer any signals about additional changes to monetary policy during 2024. Given the uncertainty about both the domestic and global economy, we think the BoJ will refrain from delivering any pre-commitments to potential further hikes post-summer, and it will likely stay nimble and highlight uncertainties. Hence, we do not expect any major rate-hiking cycle from the BoJ during the year, and markets seem to agree as there is currently 26bp worth of rate hikes priced in for the whole year.

Therefore, the timing of the widely anticipated rate-cutting cycles from especially the Fed and the ECB could prove to be more pivotal for the JPY over the course of the year. Overall, we expect narrowing rate differentials and a global environment characterized by weaker growth and inflation impulses to favour the JPY in 2024. This has not been the case in Q1, but we still deem there are downside risks to global growth over the year. The biggest risk for our positive JPY stance is a re-acceleration in global inflation – especially in the US – which could prompt the Fed to delay rate cuts. Furthermore, a rise in energy prices would likely also leave the JPY vulnerable.