- Eurozone economy has been improving in 2024

- But investors still anticipate an ECB rate cut in June

- The flash PMIs could impact bets beyond that meeting

- The data comes out on Thursday at 08:00 GMT

ECB signals confidence in lowering rates

At their latest gathering, ECB officials decided to keep interest rates unchanged as expected but they sent clearer signals that they may start lowering them soon. At the press conference, President Lagarde said that the decline in inflation is comforting and that a few members felt sufficiently confident to cut rates.

Although she did not explicitly refer to a specific timing, a few hours after her speech, a report citing three sources close to the ECB discussion revealed that policymakers were expected to cut interest rates in June.

Economy improves, but June cut a done deal

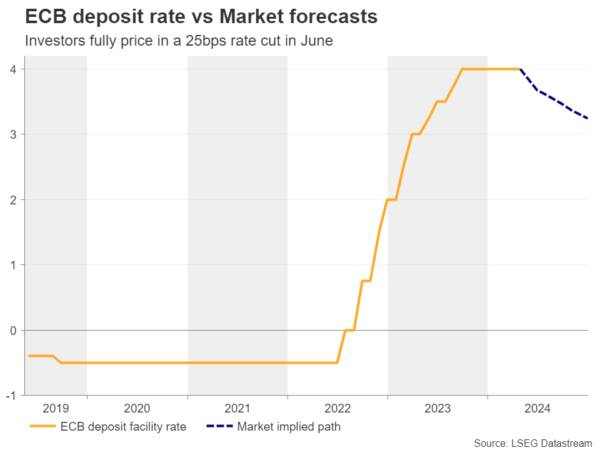

Since then, the CPI figures for April revealed that the headline rate held steady at 2.4% y/y and the core one slowed by less than anticipated, to 2.7% y/y from 2.9%. On top of that, the GDP data for Q1 pointed to a larger-than-expected rebound in Eurozone economic activity, after the bloc fell into a mild recession during the second half of 2023. According to the PMIs, the improvement continued in April, but investors remained convinced that the ECB will deliver its first quarter-point cut in June. They are pricing 40 more basis points for the rest of the year.

On Thursday, the flash PMI surveys for May are due to be released and the forecasts point to more improvement. That said, with ECB policymakers themselves continuing to signal a strong likelihood for a first rate reduction in June, investors are unlikely to scale back their June cut bets even if there is an upside surprise. They could however take off the table some basis points worth of cuts expected for the rest of the year, which could still prove positive for the euro.

Euro/dollar seeks opportunity to break 1.0885

From a technical standpoint, euro/dollar pulled back after hitting resistance slightly above the 1.0885 zone, which stopped the bulls from drifting north on April 9. However, the pair remains above the downtrend line drawn from the high of December 28 and above the 200-day exponential moving average (EMA), which currently coincides with the 1.0800 key support.

Ergo, a better-than-expected set of PMIs on Thursday may encourage buyers to take the reins again and perhaps push the price above 1.0885. Such a move will confirm a higher high and perhaps pave the way towards the high of March 21 at 1.0930. A break higher could see scope for extensions towards the high of March 8 at 1.0980 or the psychological round figure of 1.1000, which offered resistance back on January 5 and 11.

On the downside, for the outlook to start looking bearish, the pair may need to drop below the key support area of 1.0725 as this will also take the action below the short-term uptrend line drawn from the low of April 16.