German data surprise boosts EUR

The US Dollar is trading lower against a mix of major currencies on Tuesday. Positive data out of Germany has boosted the single currency. The better than expected advance German gross domestic product (GDP) reading at 0.8 percent is further proof that the largest economy in the EU is firing in all cylinders. The Eurozone’s GDP met the estimate at 0.6 percent with the market now awaiting inflation and retail sales data out of the United States.

The US Bureau of Labor Statistics will publish the change in consumer prices on Wednesday, November 15 at 8:30 am EST. At the same time the US Census Bureau will release the monthly retail sales data. Core inflation is forecasted to come in at 0.2 percent on a monthly basis adding up to a 1.7 percent year to year comparison. Core retail sales are expected to have gained 0.2 percent in October.

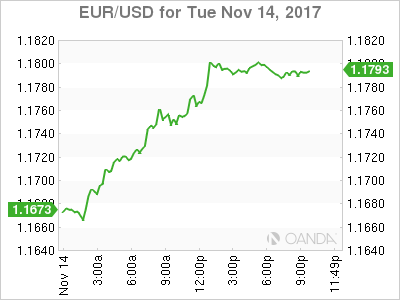

The EUR advanced more than 1 percent versus the USD even though the US Producer Price Index (PPI) released in the US beat expectations with a 0.4 gain in October. The rise in producer price inflation failed to spark a dollar recovery as the U.S. Federal Reserve December rate hike is already priced in, and the data just validates the telegraphed decision by the central bank.

The EUR/USD gained 1.07 percent on Tuesday. The single currency is trading at 1.1792 and threatening the 1.18 price level. The growth story in the EU pushed the EUR ahead of the USD. The eurozone could beat the US for the second time in a row driven by strong German GDP growth, but also a stable pace from the rest of the member states. The economic recovery hasn’t convinced the European Central Bank (ECB) to fully remove its stimulus spending, but after announcing its tapering plans an end to negative rates could be close.

The US tax overhaul remains shrouded in uncertainty as the market digests the different versions and its impact on the economy. There is vote planned for Thursday by House Republicans with the idea that there will be two bills that could pass before they are reconciled. The year end deadline could be reached if this strategy is used as there is still plenty of resistance to some part of the tax proposals. The US senate would be ready to approve their version after US Thanksgiving.

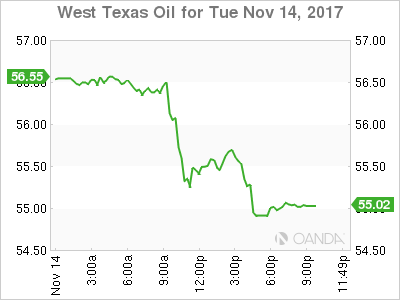

The price of crude fell 2 percent on Tuesday. West Texas Intermediate is trading at $55.54 after the International Energy Agency lowered its crude demand forecast and earlier weaker than expected economic data out of China gave credibility to the demand downgrade. Oil had risen after the arrest two weeks ago in Saudi Arabia and optimistic forecasts by the Organization of the Petroleum Exporting Countries (OPEC) as well as a pledge to extend its production cut agreement with other major producers.

The IEA cut its growth forecast by 100,000 daily barrels due to warmer weather and in contrast still sees some producers taking advantage of current prices to increase production levels. Brazil, Canada and the United States are big producers not part of the OPEC deal and are expected to ramp up their supply levels. Investors sold off crude positions on the back of the news and ahead of the weekly release of US crude inventories. After the surprise buildup last week, stocks are expected to show a 2.1 million barrel drawdown on Wednesday, at 10:30 am EST when the Energy Information Administration (EIA) releases the report.

Market events to watch this week:

Wednesday, November 15

4:30am GBP Average Earnings Index 3m/y

8:30am USD CPI m/m

8:30am USD Core CPI m/m

8:30am USD Core Retail Sales m/m

8:30am USD Retail Sales m/m

8:30am 10:30am USD Crude Oil Inventories

7:30pm AUD Employment Change

Thursday, November 16

4:30am GBP Retail Sales m/m

8:30am USD Unemployment Claims

Friday, November 17

8:30am CAD CPI m/m

8:30am USD Building Permits