- We expect the Fed to maintain its monetary policy unchanged in the May meeting, in line with consensus and market pricing. The Fed will not publish updated economic projections.

- While we expect the Fed to resume cutting rates in June, we doubt Powell will opt for clear forward guidance amid

the tariff uncertainty. Growth risks remain tilted to the downside, but rising inflation expectations are still a concern.

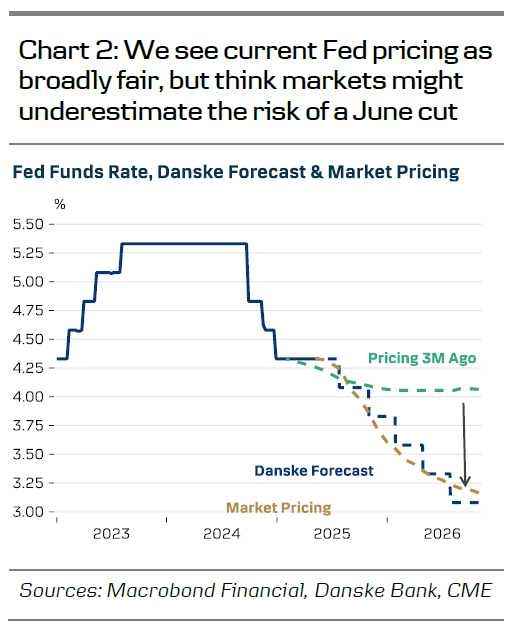

the tariff uncertainty. Growth risks remain tilted to the downside, but rising inflation expectations are still a concern. - We see current Fed pricing as broadly fair, but see risks skewed towards a dovish market reaction. We maintain our terminal rate forecast at 3.00-3.25% and 12M EUR/USD forecast at 1.22.

After a month of unprecedented tariff uncertainty, the Fed can most likely afford to stay in a ‘wait-and-see’ mode next week. While the trade war is already weighing on the economy, the effects on hard data have so far been more modest than feared. The combination of recovering equities, lower bond yields, weaker USD and lower oil prices have eased financial conditions markedly after the sharp tightening seen in early April.

FOMC participants’ views on the most likely policy implications have varied surprisingly lot over the past weeks. Christopher Waller, who has often been seen as the consensus voice of the committee, took a clear step towards the dovish camp by firmly labelling tariff-driven inflation as ‘transitory’ and by warning against recessionary signs emerging in H2. Others have sounded more cautious and called for patience, as the negative supply shock on imports and rising consumers’ inflation expectations bring back uncomfortable memories from 2021.

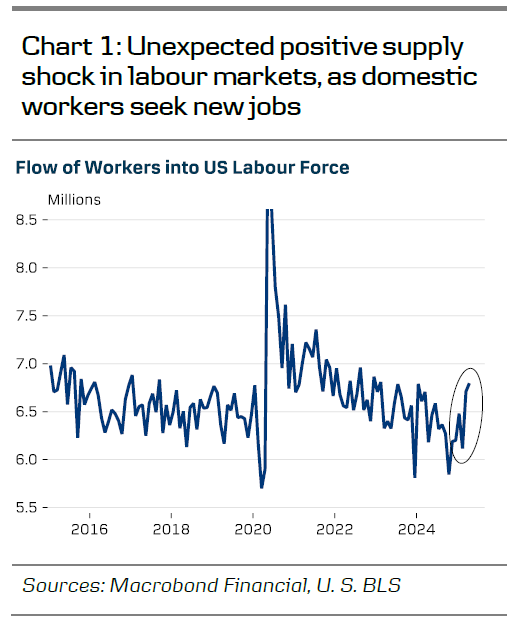

The key difference to post-Covid inflation is that the aggregate supply outside of imported goods has not been negatively affected by the trade war, but even the opposite. Last Friday’s Jobs Report showed an unexpected uptick in domestic labour supply (chart 1), as the fear of weaker job prospects might have motivated those outside the labour force to seek employment. March JOLTs data showed the ratio of job openings to unemployed job seekers declining to 1.02 – the least overheated level since mid-2021. Balanced labour markets reduce the risk of persistent inflation, in our view.

Markets are pricing 112bp of rate cuts by June 2026 – not far from our call of 125bp (chart 2). We think the most likely timing for the next cut is the following meeting in June, but do not anticipate Powell to pre-commit at this stage. As market sentiment has stabilized, the Fed has little incentive for providing forward guidance amid the obvious tariff uncertainty. By June and July, the Fed will likely have much more clarity on both the final level of China tariffs as well as the future of the other ‘reciprocal’ tariffs.

Market prices in only 8bp for the June meeting, which leaves risks mildly skewed towards a dovish reaction. We see EUR/USD moving higher over the coming year with a 12M target of 1.22, and 10y UST yield declining to 4.20%. Upside risks to yields are more related to the term premium component, than risk-neutral rate expectation. Finally, we do not expect changes to the QT after the taper announcement in March.