- Producer Price Index (PPI) ex. Food & Energy (Core) (YoY): 3.0% vs 3.1% expected, miss of -0.1%

- Producer Price Index (PPI) ex. Food & Energy (Core) (MoM): 0.1% vs 0.3% expected, miss of -0.2%

- Producer Price Index (PPI) (YoY): 2.6% vs 2.6% expected, meets consensus

- Producer Price Index (PPI) (MoM): 0.1% vs 0.2% expected, beat of +0.1%

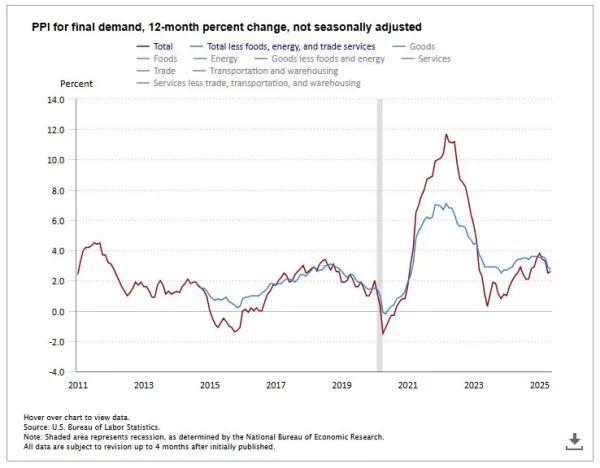

Producer Price Index YoY, Bureau of Labor Statistics (BLS), 12/06/2025

US Producer Price Index Report (May 2025):

Breaking: US core PPI falls to 3.0% YoY in May, up 0.1% MoM. The report misses expectations, with markets predicting a higher rate of 3.1% YoY.

As part of the same release, non-core PPI rose to 2.6% YoY, up 0.1% MoM.

Key takeaway: Core US producer inflation is falling faster than previously expected.

Market Reaction

In the minutes following the release, EUR/USD rose by 0.18%, partially recovering daily losses, while the Dow Jones /fell by 0.10%.

In the minutes that followed the release, EUR/USD rose by 0.18%, extending daily gains, while the Dow Jones also rose by 0.05%. Gold (XAU/USD) also trades higher, up/down 0.05% since the release.