- Fed cuts rate to 4.00–4.25% because of labor market situation in US

- Interest rate cuts in the Eurozone are in question due to inflation being under control

- Negative divergence has appeared on EURUSD, which can be a sign of correction ahead

FED Policy

The United States Federal Reserve has decided to cut interest rates by 25 basis points, bringing the main rate to the 4.00-4.25% range. This is the first change after a nine-month pause in the cycle, and the decision itself is precautionary. The Fed, guided by a “risk management” approach, did not react to a specific economic shock but acted prudently amid increasing uncertainty.

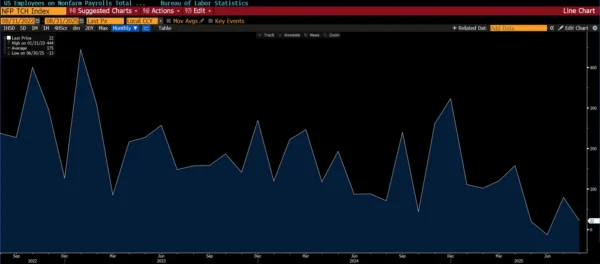

A new element of communication was the growing attention paid to the labor market situation – despite relatively stable inflation and unemployment, a slowdown in the pace of employment and limited recruitment activity are visible, which may indicate the market’s susceptibility to deterioration.

Non Farm Payrolls (in thousands), source: Bloomberg

ECB Policy

Meanwhile, in Europe, during the Eurogroup meeting in Copenhagen, members of the European Central Bank’s Governing Council, Madis Muller and Mario Centeno, presented the ECB’s monetary policy stance. The current policy remains moderately accommodative, and interest rates – including the deposit rate at 2% – have not changed in recent months. President Christine Lagarde emphasized that the ECB is at an opportune moment to achieve its 2% inflation target.

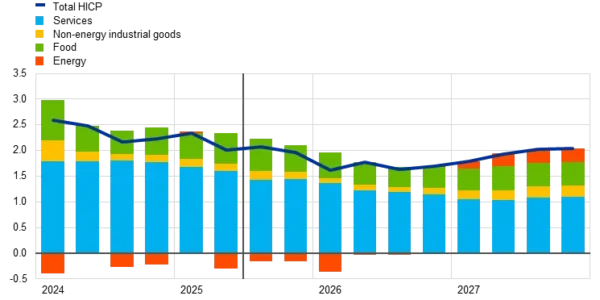

Madis Muller noted that inflation is currently “more or less on target,” and the current level of rates supports economic growth, which in the coming quarters will be more dependent on domestic demand. Mario Centeno, in turn, pointed out the current risks to growth and inflation, which he believes are trending downwards. He did not rule out a future interest rate cut, although he currently sees no urgent need for it. The ECB forecasts inflation at 1.9% in 2027 and GDP growth of 1.3%. Structural challenges, such as higher tariffs from the US, weak industrial demand, and a growing propensity to save, limit the potential for economic recovery in the euro area.

HICP ECB Projections, source: European Central Bank

EUR/USD

EURUSD, daily timeframe, source: TradingView

In the foreign exchange market, the EURUSD pair has been in an upward trend since mid-January, when the exchange rate rose from 1.0178 to 1.1918, representing an almost 17% increase. Despite this, technical analysis indicates the possibility of a correction – a negative divergence has formed between the price and the RSI indicator. In the region of 1.14, there is important technical support – both horizontal and resulting from previous corrections within the trend.

A decline to this level could be merely a natural correction within a broad upward trend. Potential doubts about further US rate cuts could accelerate such a descent without disturbing the long-term upward structure. In turn, maintaining the current monetary policy in the euro area may strengthen the common currency’s fundamentals against the dollar in the medium term.