Here are the latest developments in global markets:

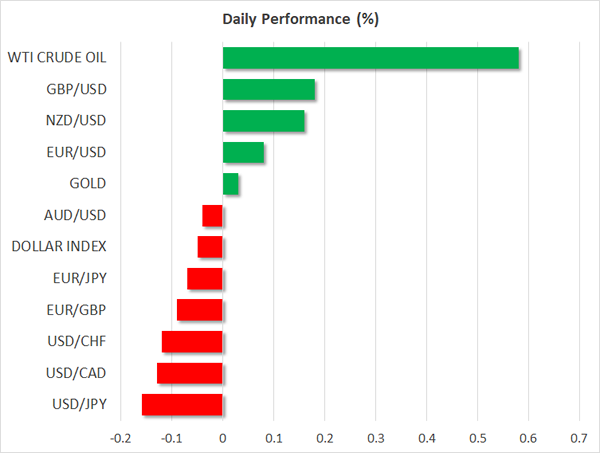

FOREX: The dollar traded marginally lower against a basket of major currencies, touching its lowest level since late November.

STOCKS: Japan’s Nikkei 225 closed lower, albeit by less than 0.1%, while Hong Kong’s Hang Seng was up by nearly 0.3%. Futures tracking the Euro Stoxx 50 were up 0.2%, while those tracking the Dow Jones, S&P 500 and Nasdaq were all higher by roughly 0.1%. The Dow yesterday finished at an all-time high, though its gains were limited as it rose by around 0.3%.

COMMODITIES: WTI and Brent crude were both up by 0.6%, with WTI breaking above the $60/barrel level to touch a fresh more than two-year high, a few hours after the weekly EIA inventory data showed a bigger-than-anticipated drawdown in US crude stockpiles. Gold traded higher, but only marginally so, possibly buoyed by the greenback’s ongoing weakness. The precious metal was up 0.05%, at $1295 per ounce. Meanwhile, copper continued to extend its recent gains, though it too did not add much relative to yesterday’s close.

Major movers: Dollar records fresh one-month low; oil reaches highest since June 2015

The US dollar continued to bleed during Friday’s Asian trading session, with the dollar index currently near 92.5, its lowest point since late-November. Given the absence of any major market news, the greenback’s underperformance in the past days may be owed primarily to end-of-year flows as major funds liquidate the remainder of their positions for the year, with the moves possibly exacerbated by thin liquidity conditions.

The US currency also underperformed its European and Japanese counterparts. Euro/dollar traded 0.1% higher to touch the 1.1958 level before pulling back slightly. Meanwhile, dollar/yen is almost 0.2% lower, currently trading near 112.64.

The Canadian dollar extended its latest gains as WTI oil prices surged further to touch levels last seen in 2015. Higher oil prices are perceived as a bullish factor for the loonie, considering Canada’s status as a major oil exporter. Dollar/loonie was down 0.1% in Asian trading Friday, after having dropped notably on Thursday. The pair is currently trading a few pips above the 1.2550 zone and if the bears prove strong enough to break below that hurdle, they could aim for the next major support territory at the crossroads of the 1.2470 level and the 23.6 Fibonacci retracement of the May 5 – September 8 collapse.

As for the rest of the commodity-linked currencies, aussie/dollar was marginally lower despite the advances in copper prices. On the other hand, kiwi/dollar caught a bid, trading nearly 0.2% higher. It is worthy to note that both pairs are trading near 2-month highs, boosted in recent days by the dollar’s softness and the gains in commodity prices in general.

Day ahead: Quiet day with German inflation numbers attracting some attention

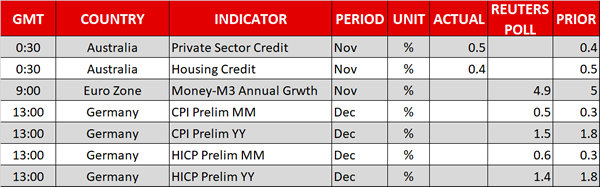

It will be an extremely quiet day in terms of releases out of major economies, with inflation data out of the eurozone’s – as well as Europe’s – largest economy being the only release expected to generate some investor interest.

Preliminary December CPI figures out of Germany are forecast to accelerate on a monthly basis relative to November and decelerate on an annual basis. The harmonized figures (HICP), which facilitate comparisons between EU nations, are projected to behave in a similar manner, i.e. grow at a faster pace month-on-month and at a slower one year-on-year.

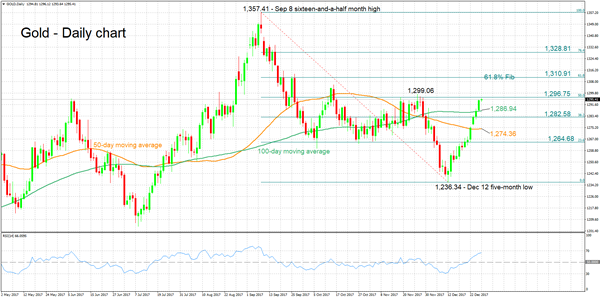

Technical Analysis: Gold short-term bullish; records fresh one-month high

Gold hit a fresh one-month high of 1,296.12 during today’s trading after finishing higher in the six preceding trading days. The precious metal is bullish in the short-term, with the RSI supporting this view: the indicator has been rising in recent days and currently maintains a positive slope. Notice though that it is edging closer to the 70 overbought level; it is currently at 66.

The dollar-denominated metal has been gaining on the back of dollar weakness as of late and a catalyst driving the dollar higher could lead to falling gold prices. In such an event, the yellow metal might find support around the current level of the 100-day moving average at 1,286.94. Additional support to steeper declines could come around the 38.2% Fibonacci mark of the September 8 to December 12 downleg at 1,282.58.

On the upside and should gold continue advancing, resistance could be met around the 50% Fibonacci level at 1,296.75. Notice that the area around this point also encapsulates a top from the recent past (November 27’s 2-½-month high of 1,299.06) as well as being close to the 1,300 handle, this being a potential psychological level. Also bear in mind that the price is currently in proximity to the 50% Fibonacci mark. Further above, the focus would shift to the 61.8% Fibonacci level at 1,310.91 as an additional barrier to the upside.