For the 24 hours to 23:00 GMT, the EUR rose 0.63% against the USD and closed at 1.2427.

In economic news, Germany’s Markit construction PMI declined to a 13-month low level of 52.7 in February, after registering a nearly 7-year high reading of 59.8 in the preceding month.

The greenback nursed losses against its key peers, after Gary Cohn, Donald Trump’s top economic adviser, announced his resignation after Trump vowed to stick with his plans of imposing hefty tariffs on steel and aluminium imports.

In the US, data indicated that factory orders slid 1.4% on a monthly basis in January, in line with market expectations and dropping for the first time in 6 months. In the prior month, factory orders had recorded a revised gain of 1.8%. Moreover, final reading of durable goods orders fell less than initially estimated by 3.6% on a monthly basis in January, while the preliminary figures had indicated a fall of 3.7%. In the previous month, durable goods orders had recorded a revised rise of 2.6%.

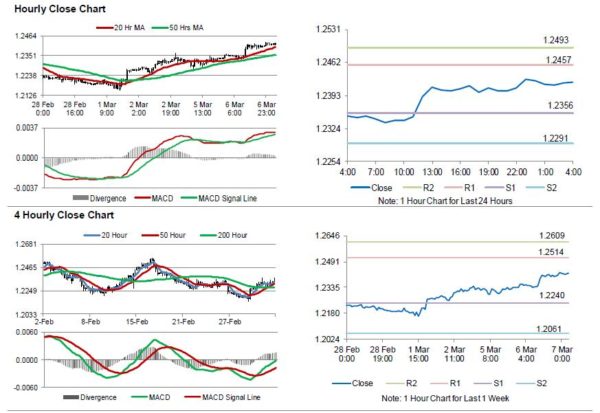

In the Asian session, at GMT0400, the pair is trading at 1.2420, with the EUR trading 0.06% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2356, and a fall through could take it to the next support level of 1.2291. The pair is expected to find its first resistance at 1.2457, and a rise through could take it to the next resistance level of 1.2493.

Going ahead, investors would eye the Euro-zone’s final 4Q GDP numbers, slated to release in a few hours. Later in the day, the US ADP employment change for February, trade balance for January as well as MBA mortgage applications data, would attract significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.