For the 24 hours to 23:00 GMT, the USD declined 0.33% against the CAD and closed at 1.2868 on Friday.

The Canadian Dollar advanced against the USD on Friday, following better-than-anticipated Canadian inflation figures.

Data revealed that Canada’s consumer price index (CPI) advanced 2.2% on an annual basis in February, rising at its fastest pace in 3 years and cementing hopes of a Bank of Canada interest rate hike over the coming months. Market participants had envisaged the CPI to gain 1.9%, after recording a rise of 1.7% in the previous month. Moreover, the nation’s retail sales rebounded 0.3% on a monthly basis in January, exceeding market consensus for a rise of 1.1%. Retail sales had registered a revised drop of 0.7% in the prior month.

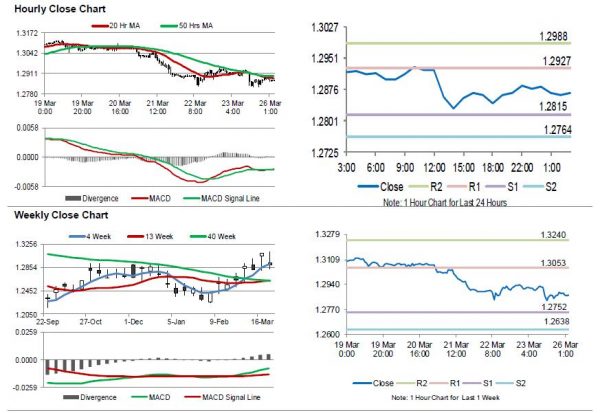

In the Asian session, at GMT0300, the pair is trading at 1.2867, with the USD trading marginally lower against the CAD from Friday’s close.

The pair is expected to find support at 1.2815, and a fall through could take it to the next support level of 1.2764. The pair is expected to find its first resistance at 1.2927, and a rise through could take it to the next resistance level of 1.2988.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.