For the 24 hours to 23:00 GMT, the EUR declined 0.15% against the USD and closed at 1.2301.

On Thursday, data revealed that Germany’s preliminary consumer price index (CPI) advanced less-than-anticipated by 1.6% on an annual basis in March, highlighting that inflation might continue to remain sluggish in 2018 despite nascent domestic growth. In the prior month, the CPI had risen 1.4%, while markets had expected for a gain of 1.7%. Meanwhile, the nation’s seasonally adjusted unemployment rate dropped to 5.3% in March, at par with market expectations, thus pointing to strengthening labour market in the Euro-zone’s largest economy. Unemployment rate had recorded a level of 5.4% in the previous month.

The US Dollar declined against a basket of major currencies, amid renewed fears of a trade war between the US and China, after China implemented $3.0 billion in new tariffs on US goods.

On the macro front, the US ISM manufacturing activity index declined more-than-anticipated to a level of 59.3 in March, compared to market expectations for a fall to a level of 59.7. The index had registered a level of 60.8 in the prior month. Meanwhile, the nation’s final Markit manufacturing PMI climbed less than initially estimated to a level of 55.6 in March, compared to a reading of 55.3 in the prior month.

Another set of data showed that construction spending in the US grew 0.1% MoM in February, undershooting market expectations for a gain of 0.4%. In the previous month, construction spending had recorded a flat reading.

On Thursday, data indicated that first time claims for the US unemployment benefits recorded an unexpected drop to a level of 215.0K in the week ended 24 March, hitting its lowest level in more than 45 years. Initial jobless claims had registered a revised level of 227.0K in the prior week, while markets were expecting for an increase to a level of 230.0K. Moreover, the nation’s personal income rose 0.4% on a monthly basis in February, meeting market expectations and following a similar rise in the previous month. Further, the nation’s personal spending climbed 0.2% MoM in February, in line with market expectations. Personal spending had registered a similar rise in the prior month.

In other economic news, the US final Reuters/Michigan consumer sentiment index advanced to a level of 101.4 in March, while the preliminary figures had indicated a rise to a level of 102.0. In the previous month, the index had recorded a reading of 99.7. Meanwhile, the nation’s Chicago Fed purchasing managers’ index (PMI) surprisingly eased to a level of 57.4 in March, defying market consensus for an advance to a level of 62.0. In the prior month, the index had registered a reading of 61.9.

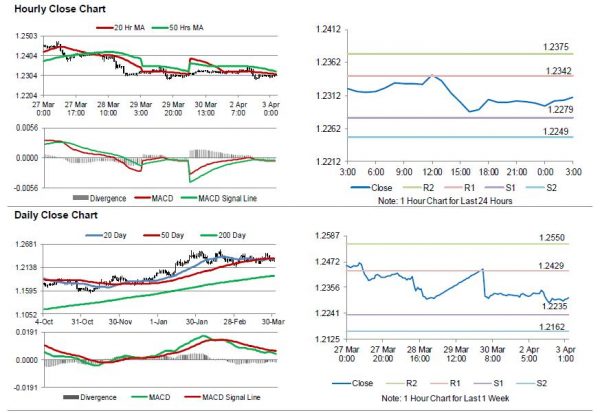

In the Asian session, at GMT0300, the pair is trading at 1.2309, with the EUR trading 0.07% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2279, and a fall through could take it to the next support level of 1.2249. The pair is expected to find its first resistance at 1.2342, and a rise through could take it to the next resistance level of 1.2375.

Moving ahead, investors would look forward to the final Markit manufacturing PMI for March, scheduled to release across the Euro-zone in a few hours. Also, Germany’s retail sales data for February, will be eyed by traders.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.