Key Highlights

- The US Dollar is trading in a bullish zone above the 0.9880 support against the Swiss Franc.

- There is a crucial bullish trend line formed with support at 0.9880 on the 4-hours chart of USD/CHF.

- The US durable goods orders decreased 0.6% in May 2018 (MoM), less than the forecast of -1.0%.

- Today in the US, the GDP figure for Q1 2018 will be released, which is forecasted to grow 2.2%.

USDCHF Technical Analysis

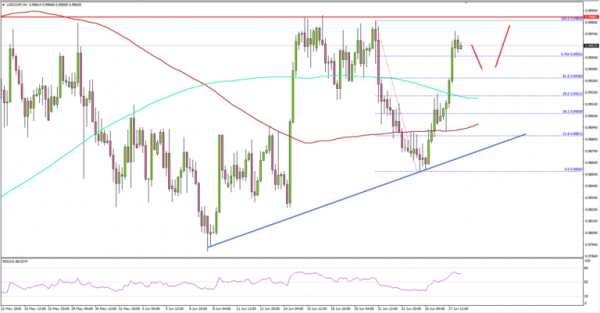

The US Dollar found a strong support near the 0.9855 level against the Swiss Franc. The USD/CHF pair started a fresh upside wave and traded above the 0.9900 and 0.9910 resistance levels.

During the upside move, the pair broke the 50% Fib retracement level of the last drop from the 0.9985 high to 0.9855 low. It also moved above the 0.9920 resistance and the 100 simple moving average (red, 4-hours).

More importantly, there was a close above the 61.8% Fib retracement level of the last drop from the 0.9985 high to 0.9855 low. It seems like the pair is placed nicely in a bullish trend and it could trade towards the 0.9980 level in the near term.

On the downside, the 0.9920 support and the 200 simple moving average (green, 4-hours) are likely to act as a supports. There is also a crucial bullish trend line formed with support at 0.9880 on the 4-hours chart.

Therefore, dips remains supported above 0.9900 and 0.9880. On the upside, resistances are at 0.9985 and 1.0000.

Recently in the US, the durable goods orders report for May 2018 was released by the US Census Bureau. The market was looking for a decline in orders by 1% in May 2018 compared with the previous month.

However, the actual result was a bit better as the decline was 0.6%. Looking at the durable goods orders ex transportation, there was a decline of 0.3%, whereas the market was looking for a rise of 0.5%.

The overall market sentiment still supports the US Dollar, and there are chances of more declines in EUR/USD and GBP/USD in the near term.

Economic Releases to Watch Today

- Germany’s GfK Consumer Confidence for July 2018 – Forecast 10.6, versus 10.7 previous.

- Euro Zone Consumer Confidence June 2018 – Forecast -0.5, versus -0.5 previous.

- Euro Zone Services Sentiment June 2018 – Forecast 14.2, versus 14.3 previous.

- German Consumer Price Index for June 2018 (YoY) (Prelim) – Forecast +2.1%, versus +2.2% previous.

- German Consumer Price Index for June 2018 (MoM) (Prelim) – Forecast +0.1%, versus +0.5% previous.

- US Initial Jobless Claims – Forecast 220K, versus 218K previous.

- US Gross Domestic Product Q1 2018 – Forecast 2.2% versus previous 2.2%.