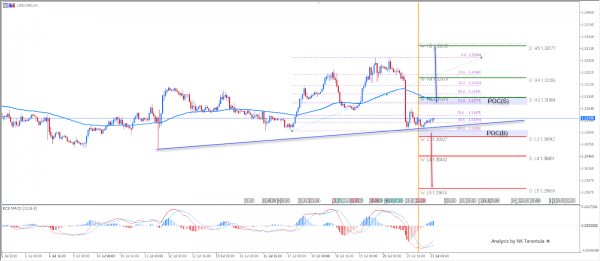

The USD/CAD has been consolidating between two weekly pivot points that are in confluence with daily pivots too. 1.3094 and 1.3190 are support and resistance, respectively. A 4h candle close ot 1h momentum candle below 1.3090 should target 1.3045 followed by 1.2960. On the contrary, a bounce or 4h candle close above 1.3190 should target 1.3238 and 1.3317.

Have in mind that the USD/CAD is exactly at 88.6 right now, so we might see a bounce first.

W L3 – Weekly Camarilla Pivot (Weekly Interim Support)

W H3 – Weekly Camarilla Pivot (Weekly Interim Resistance)

W H4 – Weekly Camarilla Pivot (Strong Weekly Resistance)

D H4 – Daily Camarilla Pivot (Very Strong Daily Resistance)

D L3 – Daily Camarilla Pivot (Daily Support)

D L4 – Daily H4 Camarilla (Very Strong Daily Support)

POC – Point Of Confluence (The zone where we expect price to react aka entry zone)