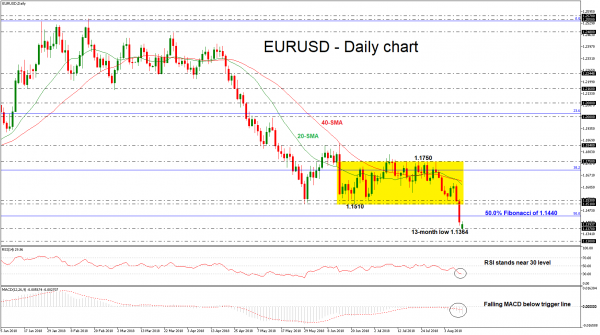

EURUSD sank to a fresh 13-month low of 1.1364 on Monday and opened the day with a gap down after the aggressive bearish session in the preceding week. The world’s most traded currency endorses the negative movement as it holds below the narrow range of 1.1530 – 1.1750 and the 50.0% Fibonacci retracement level of the upleg from 1.0340 to 1.2550, around 1.1440.

In the daily timeframe, the technical structure suggests further losses. The RSI indicator is trying to enter the oversold territory, while the MACD oscillator dives below its trigger line and lies in the negative zone. The 20- and 40-simple moving averages (SMAs) completed a bearish crossover and are far away from the current market price.

In the wake of negative pressures, the market could meet support at the 1.1300 psychological level, taken from the low on July 2017. A successful close below this level could see a test of the 61.8% Fibonacci, near 1.1180 before bearish actions strengthen towards the 1.1115 support, where the price bottomed on June 2017.

However, if prices are unable to break the aforementioned 13-month low in the next few sessions, the risk would shift back to the upside, with the 50.0% Fibonacci of 1.1440 coming into focus. A jump above this level would signal a bullish correction of the sharp sell-off and the next key levels for investors to have in mind are the 1.1510 and 1.1530 marks.

Overall, EURUSD opened the way for a strong negative movement after the drop below the narrow range, turning the medium-term picture even more bearish.