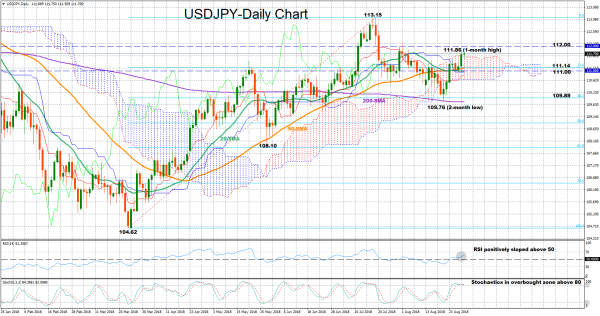

USDJPY came close to breaking the 112.00 level on Wednesday, finishing the day at a one-month high of 111.86. According to the RSI, the market could maintain positive momentum in the short-term as the indicator is positively sloped above its neutral threshold of 50, though the fast Stochastics suggest that the market is located in overbought territory and therefore some weakness is possible; the green %K line is fluctuating around the red %D line in overbought zone above 80.

On the upside, the price could attempt to overcome the 111.86 high and retest the 112.00 round level, which if successfully broken the door could open for the 113.00 psychological level and the 113.15 top reached on July 19. Should traders continue to buy the pair above that peak, bringing the long-term uptrend back into play, resistance could then run towards the 114-114.72 area.

A reversal to the downside, however, could find immediate support at the 23.6% Fibonacci of the upleg from 104.62 to 113.15, around 111.14, while slightly lower the 111.00 key-level could also come into view. If the latter fails to halt bearish movements, the next target could be the 38.2% Fibonacci of 109.89 ahead of the 200-day SMA which currently lies near the two-month low of 109.76 marked on August 21.

Turning to the medium-term trading, the outlook is neutral over the past three months and only a decisive close above 113.15 could resume the bullish picture. On the other hand, a significant decline below May’s trough of 108.10 could shift the outlook to bearish.