Key Highlights

- The New Zealand Dollar declined recently and traded towards 0.6500 against the US Dollar.

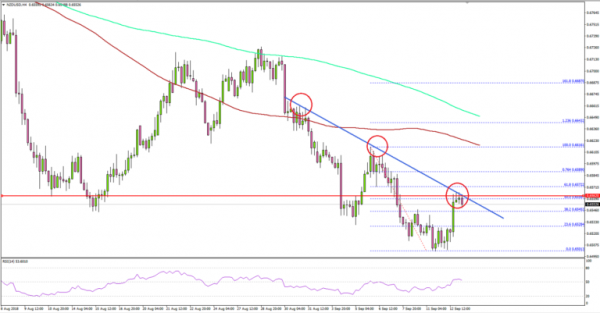

- There is a major bearish trend line formed with resistance at 0.6560 on the 4-hour chart of NZD/USD.

- The US Producer Price Index in August 2018 declined 0.1%, compared with the +0.2% forecast.

- Today, the US Consumer Price Index for August 2018 will be released, which is forecasted to rise 2.8% (YoY).

NZDUSD Technical Analysis

The New Zealand Dollar remained in a crucial downtrend from the 0.6620 swing high against the US Dollar. The NZD/USD pair recently traded towards 0.6500 and it is currently correcting higher.

Looking at the 4-hours chart, the pair is clearly under a lot of pressure below the $0.6570 resistance and the 100 simple moving average (red, 4-hours). Recently, it formed a low at 0.6501 and later corrected a few higher.

On the upside, there is a strong resistance area near 0.6560-70, which was a support earlier. It also coincides with the 50% Fib retracement level of the last drop from the 0.6616 high to 0.6501 low.

Moreover, there is a major bearish trend line formed with resistance at 0.6560 on the same chart. Therefore, if the pair recovers further, it is likely to face a strong resistance near the 0.6570 zone. On the downside, a break below the 0.6500 support could open the gates for a push towards 0.6460.

Fundamentally, the US Producer Price Index for August 2018 was released by the Bureau of Labor statistics, Department of Labor. The market was looking for a rise of 0.2% in the PPI compared with the previous month.

However, the result was disappointing as there was a decline of 0.1% in the PPI. The yearly change came in at 2.8%, less than the forecast of 3.2% and much less than the last 3.3%.

The US Dollar corrected lower, but it could regain traction and pairs like NZD/USD and AUD/USD are likely to face an increased selling pressure in the near term.

Economic Releases to Watch Today

- German Consumer Price Index for August 2018 (YoY) – Forecast +2%, versus +2% previous.

- German Consumer Price Index for August 2018 (MoM) – Forecast +0.1%, versus +0.1% previous.

- ECB Interest Rate Decision – Forecast 0%, versus 0% previous.

- BoE Interest Rate Decision – Forecast 0.75%, versus 0.75% previous.

- BOE Meeting Minutes.

- US Consumer Price Index August 2018 (MoM) – Forecast +0.3%, versus +0.2% previous.

- US Consumer Price Index August 2018 (YoY) – Forecast +2.8%, versus +2.9% previous.

- US Consumer Price Index Ex Food & Energy August 2018 (YoY) – Forecast +2.4%, versus +2.4% previous.