The EURUSD currency pair has dropped from the recent highs, weakened by the FOMC statement, general USD strength and risk-on sentiment. The ECB president Mario Draghi welcomed the growth in the EU economy, however he failed to mention anything regarding interest rates. As head of the ECB, which controls short term interest rates, he has more influence over the euro’s value than any other person. Additionally, no major news is expected for the Euro today or next week. Don’t forget to follow our Forex calendar for all regular updates on the news, economic announcements, forecasts and much more.

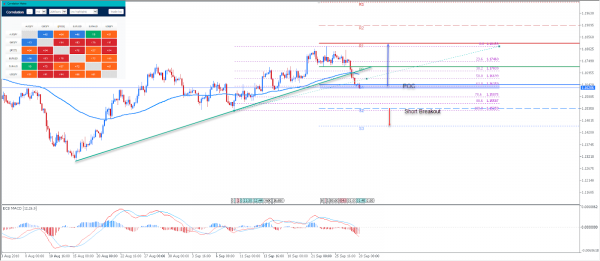

Technically, the EUR/USD currency pair has formed an ascending trend line since August, as we can see on the chart above. However the price broke below the trend line reaching the Admiral pivot point, and its close to S1 support. Rejections from the POC zone 1.1600-15 are possible as long as the 88.6 fib holds- 1.1558. A loss of 88.6 fib might put the pair into neutral-to bearish territory.The price might get a slightly higher than usual volatility at the break of S2 and 1.1525, so be careful and follow the price action as usual.

Pivot Lines – Weekly Support and Resistance

POC – POC – Point Of Confluence (The zone where we expect the price to react – aka the entry zone)