Key Highlights

- The US Dollar remained in a consistent uptrend from the 111.80 support against the Japanese Yen.

- There is a major bullish trend line formed with support at 113.60 on the 4-hours chart of USD/JPY.

- The US Initial Jobless Claims for the week ending Sep 29, 2018 declined from 215K to 207K.

- Today, the US NFP figure for Sep 2018 will be released, which is forecasted to increase 185K.

USDJPY Technical Analysis

The US Dollar started a solid upward move and traded above 114.00 recently against the Japanese Yen. The USD/JPY pair is currently placed nicely above the 113.80 and 113.50 support levels.

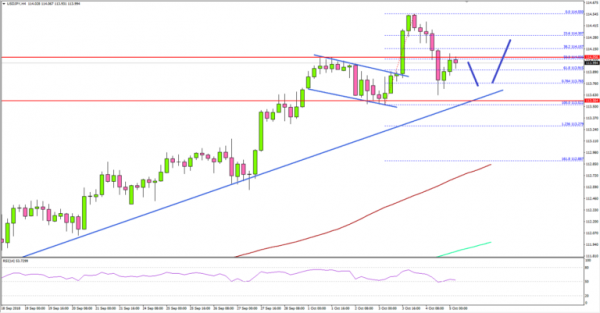

Looking at the 4-hours chart, the pair gained traction above the 113.20 resistance area. Later, there was a bullish flag formed with resistance at 113.80. Finally, buyers gained traction and the pair surged above the 113.80 and 114.00 resistance levels.

A new monthly high was formed at 114.55 before the pair started a downside correction. It moved below the 50% Fib retracement level of the last wave from the 113.52 low to 114.55 high.

However, there are many supports on the downsides such as 113.80, 113.60 and 113.50. There is also a major bullish trend line formed with support at 113.60 on the same chart. As long as the pair is trading above the 113.50 support, it remains in an uptrend and it could bounce back.

Below 113.50, the pair is likely to correct further towards the 113.00 and 112.80 supports. On the upside, an initial resistance is at 114.40 followed by the last swing high at 114.50.

Fundamentally, the US Initial Jobless Claims figure for the week ending Sep 29, 2018 was released recently. The market was looking for a decline from the last reading of 214K to 213K.

However, the result was better than the market forecast as the Initial Jobless Claims declined from the last revised reading of 215K to 207K.

The report added that:

The 4-week moving average was 207,000, an increase of 500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 206,250 to 206,500.

Overall, in the short term, there could be downsides in USD/JPY, but the overall trend remains bullish above the 113.50 and 113.00 levels.

Economic Releases to Watch Today

- US nonfarm payrolls Sep 2018 – Forecast 185K, versus 201K previous.

- US Unemployment Rate Sep 2018 – Forecast 3.8%, versus 3.9% previous.

- US Average Hourly Earnings (MoM) Sep 2018 – Forecast 0.3%, versus 0.4% previous.

- Canada’s employment Change payrolls Sep 2018 – Forecast 25K, versus -51.6K previous.

- Canada’s Unemployment Rate Sep 2018 – Forecast 5.9%, versus 6.0% previous.