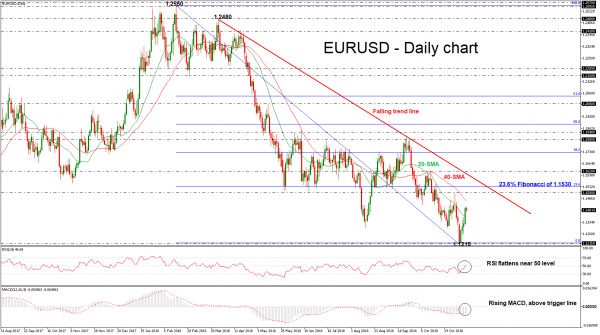

EURUSD had a bearish start on Monday, with the price developing near the crucial psychological level of 1.1400, after creating four consecutive green days in the previous week. The pair has also significantly increased its distance above its 20-day simple moving average (SMA) for the first time over the last two months, while the technical indicators seem to be neutral to bullish. The RSI indicator is moving sideways near the threshold of 50 and the MACD oscillator is strengthening its positive momentum above its trigger line and below its zero line.

Further upside recovery could retest the 40-SMA, which stands near the 1.1450 level before attention turns to the 1.1500 critical handle, taken from recent highs. Moving higher, the area of the 23.6% Fibonacci retracement level of the downleg from 1.2550 to 1.1215, near 1.1530 should be in focus, while a significant rally above this region could last until the 1.1620 resistance, taken from the high on October 16.

Should the price move lower again, the 17-month low of 1.1215 could be a key level to challenge. Below that, investors could have in mind the next support, which stands 100 pips below the previous one at 1.1115.

Regarding to the long-term picture, the bearish outlook came back into play after the violation of the 1.1300 trough on Friday. In case of a retest of the 1.1800 handle, the pair would be able to resume the neutral mode and create chances for a bullish correction.