Key Highlights

- The Euro faced a strong barrier near 1.1480 and declined recently against the US Dollar.

- EUR/USD faced a strong resistance trend line at 1.1485 on the 4-hour chart.

- The US GDP in Q3 2018 increased 3.4%, less than the forecast of 3.5%.

- Today in the US, the Chicago Fed National Activity Index for Nov 2018 will be released, and it could decline from 0.24 to 0.21.

EURUSD Technical Analysis

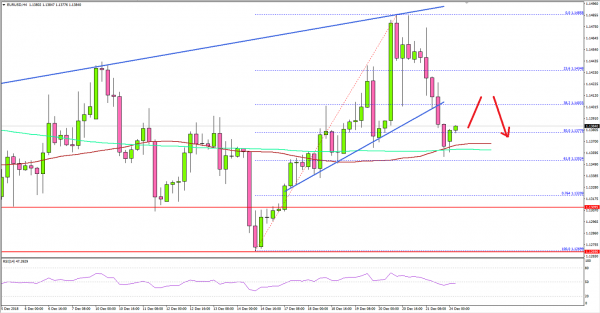

This past week, the Euro gained bullish momentum and broke the 1.1420 and 1.1450 resistance levels against the US Dollar. However, the EUR/USD pair struggled near 1.1480, resulting in a fresh drop.

Looking at the 4-hours chart, the pair climbed sharply above the 1.1420 level, but it could not even test the 1.1500 hurdle. A high was formed at 1.1485 and the pair declined heavily after the US GDP report was released this past Friday.

It seems like the pair failed near a strong resistance trend line at 1.1485 on the same chart. It declined below the 50% Fib retracement level of the last wave from the 1.1269 low to 1.1485 high.

The current drop looks real and if sellers gain pace below the 1.1350 level, there could be more losses towards 1.1320 or 1.1300. On the upside, an initial resistance is near the 1.1400 level, above which the pair might revisit the 1.1450 resistance zone.

Fundamentally, the US Gross Domestic Product report for Q3 2018 was released this past Friday by the US Bureau of Economic Analysis. The market was looking for an increase of 3.5% in the US GDP in Q3 2018.

The result was lower than the forecast as the US GDP grew 3.4% according to the “third” estimate. On the positive side, real gross domestic income (GDI) posted a solid increase of 4.3% in Q3 2018, compared with a 0.9% rise in Q2 2018.

The report added that:

The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 3.8 percent in the third quarter, compared with an increase of 2.5 percent in the second quarter.

There was a sharp rise in the US Dollar after the release and EUR/USD traded below 1.1400. AUD/USD also declined sharply, but pairs like GBP/USD and NZD/USD remained stable.

Economic Releases to Watch Today

- Chicago Fed National Activity Index for Nov 2018 – Forecast 0.21, versus 0.24 previous.

- Japan’s Corporate Service Price Index for Oct 2018 (YoY) – Forecast 1.2%, versus 1.3% previous.