Key Highlights

- The US Dollar started a decent recovery after testing the 1.3200 support against the Canadian Dollar.

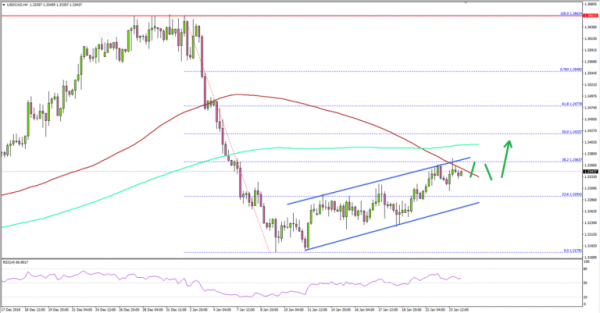

- There is a major ascending channel formed with support at 1.3280 on the 4-hours chart of USD/CAD.

- Canada’s Retail Sales declined 0.9% in Nov 2018 (MoM), compared with the -0.6% forecast.

- The US Manufacturing PMI for Jan 2019 (Prelim) will be released today, which could decline from 53.8 to 53.5.

USDCAD Technical Analysis

After a significant decline, the US Dollar found support near the 1.3180-1.3200 area against the Canadian Dollar. The USD/CAD pair started a decent recovery and moved above the 1.3250 resistance.

Looking at the 4-hours chart, the pair gained bullish momentum above the 1.3200 and 1.3250 resistance levels. There was a break above the 23.6% Fib retracement level of the last slide from the 1.3662 high to 1.3179 low.

The pair is now approaching a significant hurdle near the 1.3400 level and the 200 simple moving average (green, 4-hours). Moreover, the 50% Fib retracement level of the last slide from the 1.3662 high to 1.3179 low is at 1.3420.

Therefore, if the pair continues to move higher, it could find sellers near 1.3400, the 200 simple moving average (green, 4-hours), and the 1.3420 level. On the downside, there is a decent support formed near 1.3300 level.

Moreover, there is a major ascending channel formed with support at 1.3280 on the same chart. In the short term, there could be a minor decline, but the pair remains well supported above 1.3280 for more gains towards 1.3400 and 1.3420.

Fundamentally, the Canadian Retail Sales report for Nov 2018 was released by the Statistics Canada. The market was looking for a 0.6% decline in sales Nov 2018, compared with the previous month.

The actual result was disappointing as the Canadian Retail Sales declined 0.9%. Additionally, the last reading was revised down from 0.3% to 0.2%. The report stated that:

Retail sales decreased 0.9% to $50.4 billion in November on lower sales at gasoline stations and motor vehicle and parts dealers. Excluding these two subsectors, retail sales increased 0.2%.

Overall, the US Dollar could continue to recover against the Canadian Dollar and there are high possibilities of more gains towards 1.3420.

Economic Releases to Watch Today

- ECB Interest Rate Decision – Forecast 0%, versus 0% previous.

- Germany’s Manufacturing PMI for Jan 2019 (Preliminary) – Forecast 51.3, versus 51.5 previous.

- Germany’s Services PMI for Jan 2019 (Preliminary) – Forecast 52.1, versus 51.8 previous.

- Euro Zone Manufacturing PMI Jan 2019 (Preliminary) – Forecast 51.4, versus 51.4 previous.

- Euro Zone Services PMI for Jan 2019 (Preliminary) – Forecast 51.5, versus 51.2 previous.

- US Manufacturing PMI for Jan 2019 (Preliminary) – Forecast 53.5, versus 53.8 previous.

- US Services PMI for Jan 2019 (Preliminary) – Forecast 54.1, versus 54.4 previous.

- US Initial Jobless Claims – Forecast 220K, versus 213K previous.