Gold price rallied recently above $1,325 and later faced sellers near $1,346. Crude oil price is placed in a bullish zone, but a break below the $56.75 support could trigger a downside correction.

Important Takeaways for Gold and Oil

- Gold price tested the $1,345-1,346 resistance area and later corrected lower against the US Dollar.

- There was a break below a major bullish trend line with support at $1,335 on the hourly chart of gold.

- Crude oil price remained in an uptrend and it recently traded above the $57.00 resistance.

- There is a crucial bullish trend line in place with support at $56.75 on the hourly chart of XTI/USD.

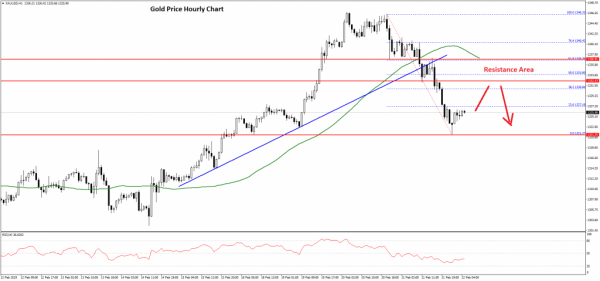

Gold Price Technical Analysis

In the past few days, there was a strong upward move from the $1,305 swing low in gold price against the US Dollar. The price gained momentum and broke the $1,320 and $1,325 resistance levels.

The price even broke the $1,340 resistance and the 50 hourly simple moving average. It traded towards the $1,345 resistance and formed a high near $1,346 on FXOpen. Later, the price started a downside correction and traded below the $1,340 support.

There was also a break below a major bullish trend line with support at $1,335 on the hourly chart of gold. The price even broke the $1,325 support and the 50 hourly simple moving average.

A low was formed near $1,321 and the price is currently correcting higher. An initial resistance is near the 23.6% Fib retracement level of the recent decline from the $1,346 high to $1,321 low. In the short term, there could be an upward move, but it is likely that sellers appear near the $1,330 resistance.

The main resistance is near the $1,335 level and the 50 hourly simple moving average. The 50% Fib retracement level of the recent decline from the $1,346 high to $1,321 low is also near the $1,333 level.

Therefore, upsides are likely to be capped near the $1,330, $1,333 and $1,335 resistance levels. On the downside, the price could test the $1,315 support before a fresh increase.

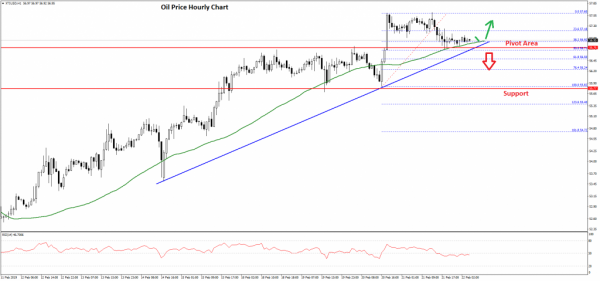

Oil Price Technical Analysis

Crude oil price followed a strong uptrend this week and climbed above the $54.00 and $55.00 resistance levels against the US Dollar. The price gained pace and broke the $57.00 resistance to climb to a new monthly high.

It traded as high as $57.60 and settled above the 50 hourly simple moving average. Later, the price started a downside correction and traded below the $57.50 and $57.30 levels.

There was a break below the 23.6% Fib retracement level of the recent wave from the $55.82 low to $57.60 high. However, there is a strong support formed near $56.75 level. There is also a crucial bullish trend line in place with support at $56.75 on the hourly chart of XTI/USD.

The 50% Fib retracement level of the recent wave from the $55.82 low to $57.60 high is also near the $56.75 level. Therefore, there are two possible outcomes – first, the price breaks the $56.75 support and correct lower towards the $55.00 support.

Alternatively, it could bounce back and break the $57.60 high in the near term. The next key resistance is near the $58.50 and $59.00 levels.