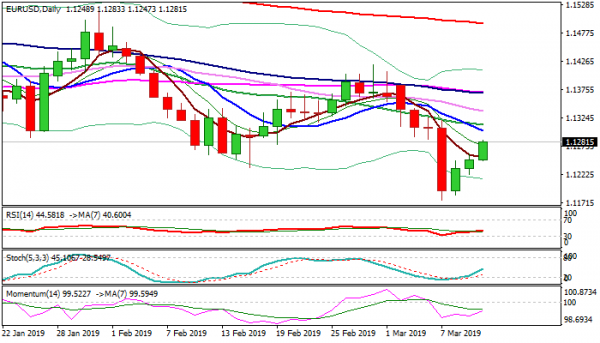

The Euro holds in green for the third straight day and extends recovery from 1.1176 low (7 Mar) through pivotal double-Fibo barrier at 1.1270 (38.2 of 1.1419/1.1176 / 23.6% of 1.1570/1.1176).

Renewed Brexit optimism positively impacted the single currency, as the dollar remains at the back foot after downbeat US NFP figures, with mild reaction on better than expected US retail sales data on Monday.

Rising daily momentum (though still in the negative territory) and north-heading RSI which also formed bull-cross, under pin recovery.

Bulls eye strong resistance zone between 1.1300 and 1.1326, consisting of 10SMA (1.1300), 20SMA (1.1312) and double-Fibo barrier at 1.1326 (38.2% of 1.1569/1.1176 / 61.8% of 1.1419/1.1176) where recovery may show signs of stall.

Failure to clear these barriers will keep larger bears in play and shift focus lower on return and close below falling 5SMA (1.1252).

Conversely, sustained break above 1.1326 would generate strong bullish signal for recovery extension towards 1.1368/71 (converged 55/100SMA’s), possibly for renewed probe above 1.14 barrier.

Res: 1.1300, 1.1312, 1.1326, 1.1336

Sup: 1.1270, 1.1252, 1.1234, 1.1186