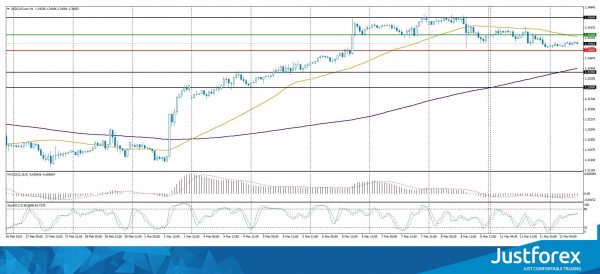

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.12342

Open: 1.12474

% chg. over the last day: +0.25

Day’s range: 1.12473 – 1.12739

52 wk range: 1.1214 – 1.2557

EUR keeps recovering after the sharp fall last week. The EUR/USD quotes are testing the local resistance at 1.12700. 1.12450 acts as a mirror support. At the same time, EUR remains under pressure due to weak economic reports from the EU, as well a growing spread between Germany and US government bonds yields. Soon EUR/USD may start descending again. Right now the investors are looking at the UK Parliament and the Brexit vote. You should open positions from the key levels.

At 14:30 (GMT+2:00) the US will publish an inflation report.

The indicators do not provide precise signals, the price fixed between 50 MA and 200 MA.

The MACD histogram is in the positive zone and keeps rising which points toward the further correction.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line which points toward a bullish mood.

Trading recommendations

Support levels: 1.12450, 1.12200, 1.11800

Resistance levels: 1.12700, 1.12900, 1.13200

If the price fixes above 1.12700, expect the quotes to recover toward 1.13000-1.13200.

Alternatively, the quotes can descend toward 1.12200-1.12000.

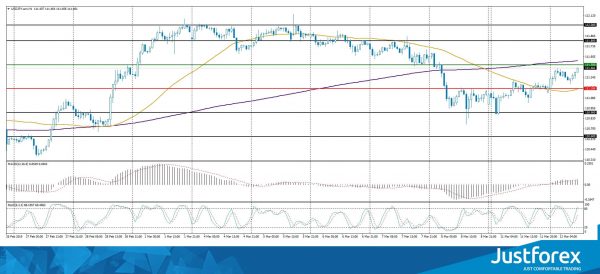

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.29668

Open: 1.31890

% chg. over the last day: +2.00

Day’s range: 1.31885 – 1.32871

52 wk range: 1.2438 – 1.4378

GBP/USD had an aggressive sell-off yesterday. The pound added 250 points against the USD. Theresa May finalized the negotiations with Jean-Claud Yunker regarding the backstop instrument. Today the attention is focused on the vote in the UK Parliament regarding the new Brexit agreement. The exact time of the vote is unknown. You should keep an eye on this event. The GBP/USD quotes are consolidating around 1.31850-1.32500. You should open positions from these levels.

The Economic News Feed for 12.03.2019:

GDP report (UK) – 11:30 (GMT+2:00);

Industrial Production Volume (UK) – 11:30 (GMT+2:00);

The price fixed above 50 MA and 200 MA which points to the power of the buyers.

The MACD histogram is in the positive zone but below the signal line, which gives a weak signal to buy GBP/USD.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which points toward a bullish mood.

Trading recommendations

Support levels: 1.31850, 1.31100, 1.30700

Resistance levels: 1.32500, 1.33000

If the price fixes above the resistance level of 1.32500, expect the quotes to grow toward 1.33000-1.33500.

Alternatively, the quotes can fall toward 1.31200-1.30700.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.34148

Open: 1.33944

% chg. over the last day: -0.18

Day’s range: 1.33853 – 1.34060

52 wk range: 1.2248 – 1.3664

USD/CAD keeps trading in a flat. There is no single defined trend. Right now the local support and resistance levels are 1.33850 and 1.34200. A technical correction for CAD is possible soon. Keep an eye on the US inflation report and the oil quotes dynamics. You should open positions from the key levels.

The Economic News Feed for 12.03.2019 is calm.

The indicators do not provide precise data, the price fixed between 50 MA and 200 MA.

The MACD histogram is in the negative zone but above the signal line, which gives a weak signal to sell USD/CAD.

The Stochastic Oscillator is in the neutral zone, the %K line is crossing the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.33850, 1.33350, 1.33000

Resistance levels: 1.34200, 1.34600, 1.35000

If the price fixes below 1.33850, expect the quotes to correct toward 1.33400-1.33200.

Alternatively, the quotes can grow toward 1.34600-1.34800.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 111.003

Open: 111.205

% chg. over the last day: +0.23

Day’s range: 111.193 – 111.464

52 wk range: 104.56 – 114.56

USD/JPY has an ambiguous picture. Right now the quotes are consolidating, with local support and resistance being 111.200 and 111.500. The demand for safe haven assets grows before the Brexit vote. The investors are waiting for the US inflatio report. You should open positions from the key levels.

The Economic News Feed for 12.03.2019 is calm.

The indicators do not provide precise signals, the price fixed between 50 MA and 200 MA

The MACD histogram is in the positive zone and keeps rising which points toward a bullish mood.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line which points toward the growth of USD/JPY.

Trading recommendations

Support levels: 111.200, 110.900, 110.600

Resistance levels: 111.500, 111.800, 112.000

If the price fixes below 111.200, expect the quotes to fall toward 110.900-110.700.

Alternatively, the quotes can grow toward 111.800-112.000.