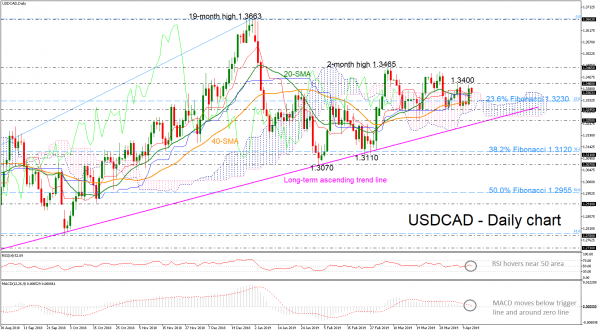

USDCAD has been remaining steady near the 23.6% Fibonacci retracement level of the upleg from 1.2250 to 1.3663 around 1.3230 over the last month, failing confirm once again its long-term upside tendency. The price is hovering within the Ichimoku cloud, while the red Tenkan-sen and the blue Kijun-sen lines are flattening. Furthermore, the RSI holds near the threshold of 50 and the MACD is standing below its trigger line and near its zero level. Both are confirming the recent bias in the daily timeframe.

In case of a jump above the psychological level of 1.3400, this may lead the price towards the two-month high of 1.3465 and an aggressive jump above this level could send the market until the 19-month high of 1.3663.

Alternatively, a failure to overcome 1.3400, would send the price back down to the 23.6% Fibonacci of 1.3230 before touching 1.3295. Lower, the 1.3250 and the ascending trend line could halt downside movements, but if not, then more losses could follow, probably towards the 38.2% Fibonacci of 1.3120, shifting the bullish long-term structure to neutral.

To sum up, in the long-term timeframe, the market has been developing in an upside movement since February 2018, completing higher highs and higher lows. However, in the short-term, only a daily close above the two-month high would resume bullish actions.