Gold price topped near the $1,290 level recently and declined below the $1,278 support area. Crude oil price also declined below the $63.00 support and it could extend losses.

Important Takeaways for Gold and Oil

- Gold price declined below the $1,280 and $1,274 support levels against the US Dollar.

- There was a break below a major bullish trend line with support at $1,282 on the hourly chart of gold.

- Crude oil price traded below a couple of important supports near the $63.00 level.

- There is a bearish trend line in place with resistance near $62.70 on the hourly chart of XTI/USD.

Gold Price Technical Analysis

Gold price faced a strong resistance near the $1,290 level against the US Dollar. As a result, the price started a downward move and broke the $1,285 and $1,280 support levels to move into a bearish zone.

There were a couple of swing moves, but the price extended losses below the $1,278 pivot level. To start the drop, there was a break below a major bullish trend line with support at $1,282 on the hourly chart of gold.

The price even broke the $1,274 support level and settled below the 50 hourly simple moving average. A swing low was formed near the $1,266 level on FXOpen and the price recently started an upside correction.

It traded above the $1,270 level and the 23.6% Fib retracement level of the latest decline from the $1,287 high to $1,266 low. However, there are many resistances on the upside near the $1,274 and $1,275 levels.

The price is likely to struggle near the $1,275 level and the 50 hourly SMA. Besides, the 50% Fib retracement level of the latest decline from the $1,287 high to $1,266 low is also near $1,276.

Therefore, to climb higher, the price must clear the $1,276 and $1,278 resistance levels. On the downside, an initial support is near the $1,270, below which the price may decline back towards the $1,265 support.

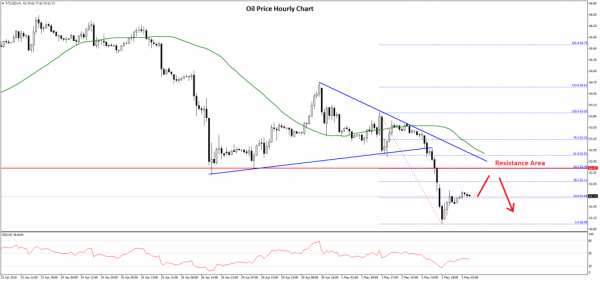

Oil Price Technical Analysis

Crude oil price started a slow and steady decline from well above the $65.00 level against the US Dollar. The price broke the $64.00 and $63.50 support levels to move into a bearish zone.

The decline was such that the price settled below the $63.00 support and the 50 hourly simple moving average. It even broke the $62.00 support and traded close to the $61.00 level.

.

A swing low was formed at $60.99 and the price is currently correcting higher. It traded above the 23.6% Fib retracement level of the recent decline from the $63.93 high to $60.99 low.

However, there are many hurdles on the upside for the bulls near the $62.50 and $62.70 levels. There is also a bearish trend line in place with resistance near $62.70 on the hourly chart of XTI/USD. The 50% Fib retracement level of the recent decline from the $63.93 high to $60.99 low is also near $62.45 to act as a resistance.

Therefore, if the price corrects higher towards $62.50, it is likely to face a strong selling interest. On the downside, an initial support is near the $61.20 level, below which the price may even break $61.00 and trade towards $60.00.