Key Highlights

- The Aussie Dollar declined recently below the 0.7070 and 0.7040 supports against the US Dollar.

- A key bearish trend line is formed with resistance near 0.7030 on the 4-hours chart of AUD/USD.

- China’s Trade Balance posted a surplus of $13.84B, well below the $35.00B forecast.

- The US PPI in April 2019 could rise 0.2% (MoM), less than the last +0.6%.

AUDUSD Technical Analysis

After a close below the 0.7100 support, the Aussie Dollar extended losses below 0.7050 against the US Dollar. The AUD/USD pair corrected higher from 0.6967, but upsides remain capped below 0.7050.

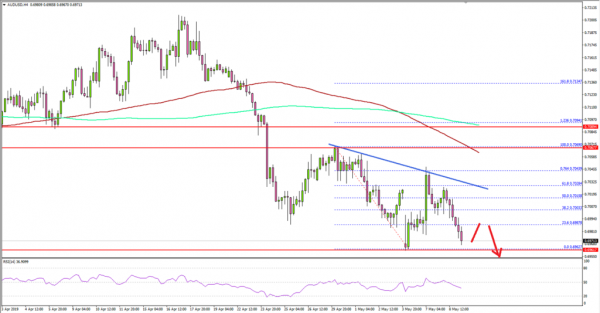

Looking at the 4-hours chart, the pair even traded below the 0.7000 support area in the recent decline. The price traded close to the 0.6960 level and settled well below the 100 simple moving average (red, 4-hours).

A swing low was formed at 0.6967 and recently the pair recovered above the 0.7000 level, and the 50% Fib retracement level of the last decline from the 0.7069 high to 0.6962 low.

However, AUD/USD struggled to surpass the 0.7050 resistance and failed near the 76.4% Fib retracement level of the last decline from the 0.7069 high to 0.6962 low. There is also a key bearish trend line formed with resistance near 0.7030 on the same chart.

Therefore, the pair could continue to struggle unless it rebounds above the 0.7030 and 0.7050 resistance levels. Still, there are many hurdles, waiting near 0.7070, the 100 SMA, 0.7090, and the 200 SMA (green).

Only a successful close above the 0.7100 level and the 200 SMA is likely to start a decent uptrend in the coming days. If not, there is a risk of more losses below 0.7000 and 0.6960 in the near term.

Fundamentally, China’s Trade Balance report was released by the General Administration of Customs of the People’s Republic of China. The market was looking for a trade surplus of around $35.00B in April 2019, up from the last $32.64B.

However, the actual result was well below the market forecast, as the trade surplus was only $13.84B. The last reading was revised from $32.64B to $32.67B. Exports of goods and services in April 2019 (YoY) were down 2.7%, whereas the market was looking for a 2.3% rise.

Clearly, there was a contraction, resulting in a minor downside reaction in EUR/USD, GBP/USD and AUD/USD. Overall, the US Dollar bulls still remain in control and both Euro and British Pound are facing many hurdles.

Economic Releases to Watch Today

- US Producer Price Index April 2019 (MoM) – Forecast +0.2%, versus +0.6% previous.

- US Producer Price Index April 2019 (YoY) – Forecast +2.3%, versus +2.2% previous.

- US Initial Jobless Claims – Forecast 220K, versus 230K previous.