Key Highlights

- The British Pound declined recently below the 1.3050 support against the US Dollar.

- A key bullish trend line is forming with support at 1.2948 on the 4-hours chart of GBP/USD.

- There are many resistances on the upside near 1.2975, 1.3020, 1.3050 and 1.3060.

- The UK Claimant Count in April 2019 could change 24.2K, less than the last 28.3K.

GBPUSD Technical Analysis

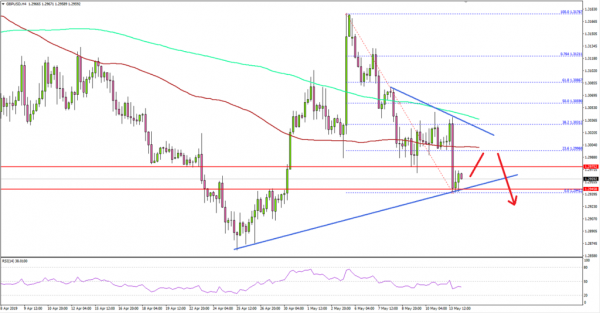

After trading towards the 1.3180 resistance, the British Pound started a significant downward move against the US Dollar. The GBP/USD pair broke the 1.3140 and 1.3060 support levels to move into a bearish zone.

Looking at the 4-hours chart, the pair broke the 1.3050 level and the 200 simple moving average (green, 4-hours). The decline was such that the pair even traded below the 1.3000 handle and the 100 simple moving average (4-hours, red).

A weekly low was formed at 1.2941 and the pair recently recovered a few pips, but it stayed well below 23.6% Fib retracement level of the major drop from the 1.3176 high to 1.2941 low.

On the upside, it seems like the 1.3050 level and the 200 simple moving average (green, 4-hours) are strong resistances along with the 38.2% Fib retracement level of the major drop from the 1.3176 high to 1.2941 low.

If there is an upside break above the 1.3030 and 1.3050 levels, GBP/USD could recover towards the 1.3100 and 1.3120 levels.

On the downside, there is a crucial support near 1.2950 and a key bullish trend line 1.2948 on the same chart. If there is a downside break below the trend line, the pair could retest the 1.2875 swing low. The next key supports are near 1.2845 and 1.2820.

On the other hand, there was a decent recovery in EUR/USD above 1.1220 and it seems like it could extend gains towards 1.1300 in the coming sessions.

Economic Releases to Watch Today

- German Consumer Price Index April 2019 (YoY) – Forecast +2.0%, versus +2.0% previous.

- German Consumer Price Index April 2019 (MoM) – Forecast +1.0%, versus +1.0% previous.

- UK Claimant Count Change April 2019 – Forecast 24.2K, versus 28.3K previous.

- UK ILO Unemployment Rate March 2019 (3M) – Forecast 3.9%, versus 3.9% previous.

- German ZEW Economic Sentiment Index May 2019 – Forecast 5.0, versus 3.1 previous.