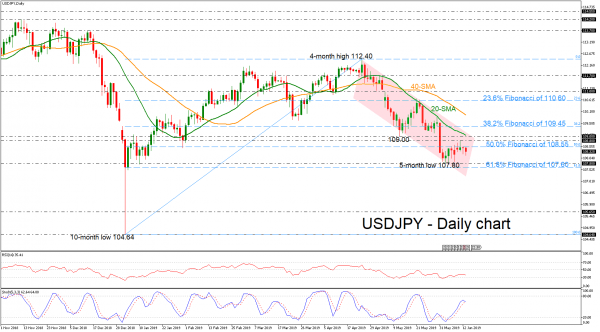

USDJPY has been on the sidelines for the most part of the week as the 109.00 level seems to be a real obstacle for the bulls. Over the last seven weeks the pair has been developing in a descending channel, erasing the bullish retracement from the 104.64 support.

Technically, the price could lose some ground in the short-term as the RSI is moving downwards in the negative area, while the stochastic is creating a bearish cross within the %K and %D lines.

A continuation of the rebound from the five-month low, could meet strong resistance between 108.80 and 109.00, where the 20-day simple moving average (SMA) is located. Exiting the channel, the 38.2% Fibonacci of the upleg from 104.64 to 112.40 near 109.45 could halt further advances.

Alternatively, a decline under five-month low (107.80) should keep the pair in a bearish mode, challenging the immediate support of the 61.8% Fibonacci region of 107.60. A strong rally below this line could open the way towards the 105.65 hurdle, identified by the low on January 2018.

In the short-term picture, USDJPY is gently pointing down after the bounce off the four-month high of 112.40. Only an upside run above the aforementioned obstacle could turn the bias back to bullish. Otherwise traders will most likely look for negative movements.