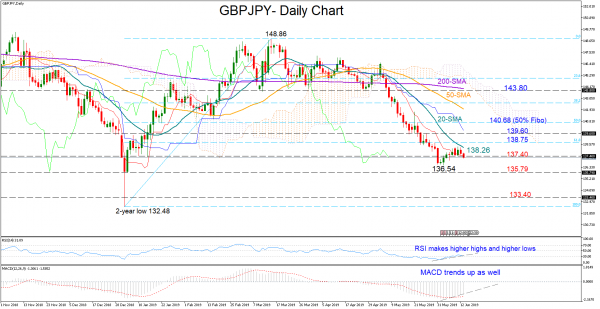

GBPJPY stabilized around a key barrier of 137.40 after bouncing on the five-month trough of 136.54.

Although the RSI is currently sloping down, the indicator seems to be building an uptrend, confirming another higher high near its 30 oversold mark earlier this week. The MACD is also trending up above its red signal line, adding further hopes for a supported market in the short-term.

The 20-day simple moving average (SMA) at 138.26 and the 61.8% Fibonacci of 138.75 of the upleg from 132.48 to 148.86 could halt upside movements ahead of the 139.60 level. Higher, the bulls should push harder to breach the 50% Fibonacci of 140.68.

A failure to hold above 137.40 would shift attention to the 136.54 bottom and the January 4 low of 135.79. If the latter proves a weak obstacle, then the way could open towards 133.40, a former support and resistance spot.

Meanwhile in the medium-term timeframe, the sentiment remains bearish. A rally above 143.80 would change the outlook back to neutral, though with the 50-day SMA moving with a steep negative slope under the 200-day SMA, such a recovery is currently looking less likely.