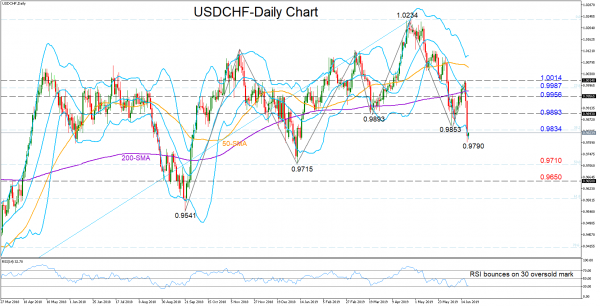

USDCHF experienced its worst daily trading in more than three years on Thursday, posting a sharp dip towards a 6 ½ -month low of 0.9790. The price is currently hovering around the lower Bollinger band, while the RSI is set to shift higher after hitting its 30 oversold mark, a warning that the bearish action may not continue in the short-term.

Yet with the market action taking place well below moving averages, the pair may need extra time to correct the recent downtrend that started from the 1.0234 top.

A failure to return above the previous low of 0.9853 would put more faith to the bearish wave triggered from the 1.0234 top, shifting focus initially to Thursday’s trough of 0.9790 and then towards 0.9710 which is the 50% Fibonacci of the 2-year old downtrend from 0.9186 to 1.0234. Breaking the latter, the next key support to watch could be the 0.9650 number.

Closing comfortably above the March 20 low of 0.9893 would revive the 2-year old upward pattern , with resistance moving near the middle Bollinger band at 0.9956. Slightly higher, the 23.6% Fibonacci of 0.9987 could also halt upside corrections ahead of the 1.0014 level.

The medium-term picture turned slightly bearish after the fall below 0.9853.

In brief, USDCHF continues to hold a negative status both in the short and the medium-term.