Key Highlights

- The Aussie Dollar started a strong recovery from the 0.6830 support against the US Dollar.

- AUD/USD broke the 0.6900 resistance and a bearish trend line on the 4-hours chart.

- The US Durable Goods Orders declined 1.3% in May 2019, more than the -0.1% forecast.

- The US Gross Domestic Product in Q1 2019 could grow 3.1%.

AUDUSD Technical Analysis

After trading as low as 0.6831, the Aussie Dollar started a strong recovery against the US Dollar. The AUD/USD pair broke the key 0.6900 resistance level to move into a bullish zone.

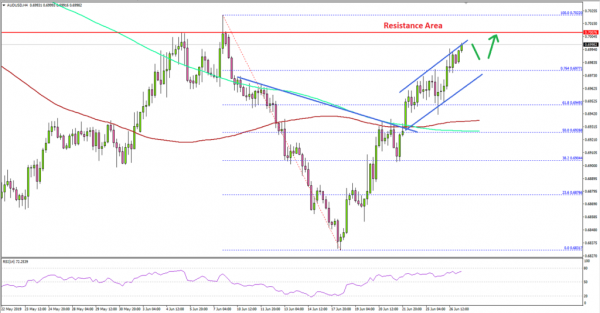

Looking at the 4-hours chart, the pair climbed steadily above the 0.6920 resistance, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

Moreover, there was a break above a bearish trend line at 0.6930 on the same chart. Finally, the pair broke the 0.6960 resistance and the 61.8% Fib retracement level of the downward move from the 0.7022 high to 0.6831 low.

The pair is showing positive signs and it could continue to rise above the 76.4% Fib retracement level of the downward move from the 0.7022 high to 0.6831 low.

However, there is a strong resistance waiting on the upside near the 0.7000 and 0.7015 levels. If there is an upside break above the 0.7022 high, the pair could rally towards the 0.7050 and 0.7060 levels.

If AUD/USD struggles near 0.7015, there could be a short term downside correction below the 0.6960 support level in the near term.

Fundamentally, the US Durable Goods Orders report for May 2019 was released by the US Census Bureau. The market was looking for a minor decline of 0.1% in orders in May 2019.

The actual result was well below the market forecast, as there was a 1.3% decline in the US Durable Goods Orders. Looking at the Nondefense Capital Goods Orders Excluding Aircraft, there was a 0.4% rise, whereas the market was only looking for 0.1%.

Overall, EUR/USD, GBP/USD, and AUD/USD remain well supported, but also facing many hurdles on the upside.

Economic Releases to Watch Today

- Euro Zone Economic Sentiment Indicator June 2019 – Forecast 104.6, versus 105.1 previous.

- German Consumer Price Index for June 2019 (YoY) (Prelim) – Forecast +1.4%, versus +1.4% previous.

- US Initial Jobless Claims – Forecast 220K, versus 216K previous.

- US Gross Domestic Product Q1 2019 – Forecast 3.1%, versus previous 3.1%.