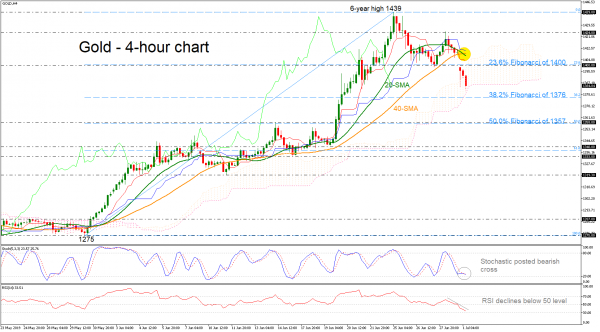

Gold prices have reversed back down again after finding resistance at the six-year high of 1439 at the end of the preceding month.

Currently, prices are developing within the Ichimoku cloud and the red Tenkan-sen and the blue Kijun-sen lines are pointing down, suggesting more losses. The 20- and 40-simple moving averages (SMAs) posted a bearish crossover in the 4-hour chart, while the stochastic oscillator and the RSI are heading towards the oversold zone.

Further losses should see the 38.2% Fibonacci retracement level of the upward movement from 1275 to 1439 near 1376. A drop below this level would reinforce the short-term bearish sentiment and open the way towards the 50.0% Fibo region near 1357.

In the event of an upside reversal, the 1400 handle, which overlaps with the 23.6% Fibonacci mark could act as significant resistance before touching the bearish cross of the SMAs around 1408. A run above these levels would drive the yellow metal towards the 1424 hurdle, taken from the latest highs.

However, for a resumption of the last month’s bullish rally, gold prices would need to beat the six-year high of 1439.