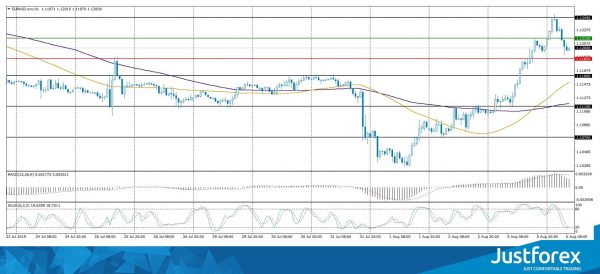

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.11039

Open: 1.12034

% chg. over the last day: +1.22

Day’s range: 1.11901– 1.12496

52 wk range: 1.1034 – 1.1817

The EUR/USD currency pair stabilized after significant growth during yesterday’s trading. The growth of the quotes exceeded 100 points. Investors began to partially fix the positions on the USD. Additional pressure on the US currency was provided by weak data on business activity in the US non-manufacturing sector from ISM. The focus remains on the trade conflict between Washington and Beijing. Currently, the EUR/USD currency pair is consolidating. The local support and resistance levels are: 1.11850 and 1.12150, respectively. We recommend opening positions from these marks.

At 17:00 (GMT+3) the US will publish the JOLTS report.

Indicators point to the strength of the buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy EUR/USD.

Stochastic Oscillator is located near the oversold zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.11850, 1.11600, 1.11150

Resistance levels: 1.12150, 1.12450, 1.12800

If the price consolidates above 1.12150, further growth of EUR/USD quotes is expected. The potential movement is to 1.12450-1.12600.

Alternatively the currency pair could decrease to 1.11600-1.11400.

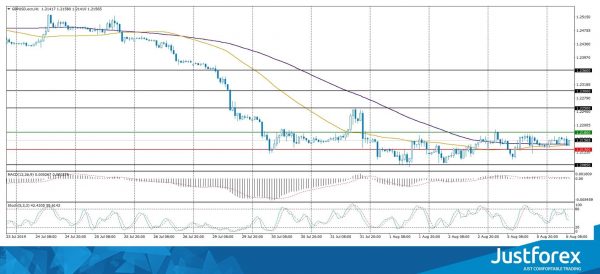

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.21297

Open: 1.21368

% chg. over the last day: +0.06

Day’s range: 1.21355 – 1.21678

52 wk range: 1.2080 – 1.3385

The GBP/USD currency pair continues to trade in a long flat. There is no defined trend. The financial market participants expect additional drivers. At the moment, the local support and resistance levels are 1.21300 and 1.21800. We recommend keeping track of current information on the Brexit issue. In the near future, technical correction of the trading instrument after a prolonged fall is quite possible. You should open positions from key levels.

The Economic News Feed for 06.08.2019 is calm.

Indicators do not provide accurate signals: the price crossed 50 MA and 100 MA.

The MACD histogram is close to 0.

The Stochastic Oscillator is in the neutral zone, the %K line is below the %D line, which gives a signal to sell GBP/USD.

Trading recommendations

Support levels: 1.21300, 1.20850, 1.20500

Resistance levels: 1.21800, 1.22500, 1.23000

If the price consolidates above 1.21800, expect a correction toward 1.22300-1.22500.

Alternatively, the price could descend toward 1.20850-1.20600.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.32110

Open: 1.32012

% chg. over the last day: -0.08

Day’s range: 1.31869 – 1.32224

52 wk range: 1.2727 – 1.3664

The USD/CAD currency pair is still in sideways movement. There are no defined trends. At the moment, the following local support and resistance levels can be distinguished: 1.31800 and 1.32150, respectively. USD/CAD quotes has the potential for further growth. We recommend paying attention to the dynamics of oil quotes. Positions must be opened from key levels.

The Economic News Feed for 06.08.2019 is calm.

Indicators do not provide accurate signals, the price has crossed 100 MA.

The MACD histogram is in the negative zone and below the signal line which indicates a bearish sentiment.

The Stochastic Oscillator has started to leave the oversold zone, the %K line is above the %D line, which gives a signal to buy USD/CAD.

Trading recommendations

Support levels: 1.31800, 1.31500, 1.31200

Resistance levels: 1.32150, 1.32450, 1.32650

If the price consolidates above 1.32150, the USD/CAD currency pair is expected to grow to 1.32500-1.32700.

Alternatively, the price could drop toward 1.31500-1.31350.

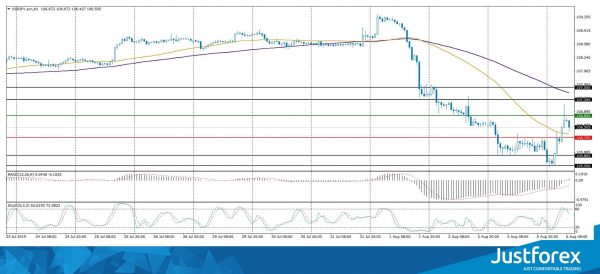

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 106.528

Open: 105.944

% chg. over the last day: -0.75

Day’s range: 105.521 – 107.088

52 wk range: 104.97 – 114.56

USD/JPY quotes began to recover after a long fall. The trading tool has updated local highs. At present, the currency of the “safe haven” is consolidating in the range of 106.250-106.800. Investors continue to monitor the trade conflict between Washington and Beijing. The US Treasury has accused China of currency manipulation. We also recommend paying attention to the dynamics of yield on US government bonds. Positions must be opened from key levels.

The Economic News Feed for 06.08.2019 is calm.

Indicators do not give accurate signals, the price has fixed between 50 MA and 100 MA.

The MACD histogram has moved into the positive zone, which indicates a further correction of the USD/JPY currency pair.

Stochastic Oscillator is in the neutral zone, the %K line is below the %D line, which gives a signal to sell USD/JPY.

Trading recommendations

Support levels: 106.250, 105.800, 105.550

Resistance levels: 106.800, 107.200, 107.500

If the price consolidates above 106.800, the price will correct toward 107.200-107.500.

Alternatively, the price could decrease toward 105.800-105.600.