Key Highlights

- The US Dollar is forming a decent support above 105.20 against the Japanese Yen.

- USD/JPY is facing a strong resistance near 106.75 and a bearish trend line on the 4-hours chart.

- The US Retail Sales in July 2019 jumped 0.7% (MoM), more than the +0.3% forecast.

- The US Building Permits in July 2019 might increase 5.6%.

USD/JPY Technical Analysis

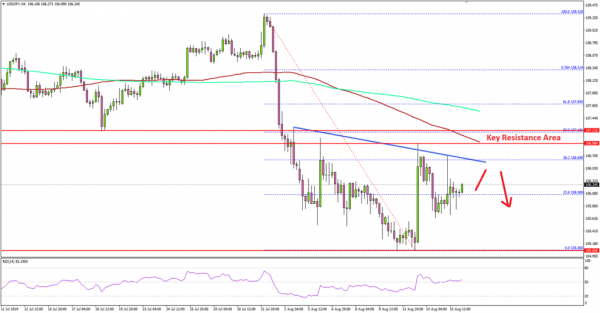

After a strong decline, the US Dollar found support near the 105.00 level against the Japanese Yen. The USD/JPY pair is currently recovering, but it is facing a strong resistance near 107.00.

Looking at the 4-hours chart, the pair is showing positive signs above the 105.50 and 105.80 levels. It traded above the 23.6% Fib retracement level of the downward move from the 109.31 high to 105.06 low.

However, the pair is facing a couple of key resistances near the 106.75 and 107.00 levels. Moreover, there is a bearish trend line in place with resistance near 106.70 on the same chart.

The key resistance is near 107.00 plus the 50% Fib retracement level of the downward move from the 109.31 high to 105.06 low. If there is an upside break above 107.00 and 107.20, the pair could accelerate gains towards the 108.00 level in the near term.

On the downside, an immediate support is near the 105.50 level. The main support is at 105.00, below which the pair could start a strong decline towards 104.20 and 104.00.

Fundamentally, the US Retail Sales report for July 2019 was released by the US Census Bureau. The market was looking for a 0.3% rise in sales compared with the previous month.

However, the actual result was much better than the forecast, as there was a 0.7% rise in sales. The Retail Sales ex Autos increased 1.0%, more than the last 0.3% and better than the +0.4% forecast.

The report added:

Advance estimates of U.S. retail and food services sales for July 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $523.5 billion, an increase of 0.7 percent (±0.5 percent) from the previous month, and 3.4 percent (±0.7 percent) above July 2018.

Looking at EUR/USD, the pair started a fresh decrease, while GBP/USD is slowly recovering towards the 1.2200 resistance area.

Economic Releases to Watch Today

- US Housing Starts July 2019 (MoM) – Forecast 1.257M, versus 1.253M previous.

- US Building Permits July 2019 (MoM) – Forecast 1.270M, versus 1.232M previous.