Key Highlights

- The Euro started an upside correction from the 1.1051 low against the US Dollar.

- EUR/USD could face resistance near 1.1200 and a bearish trend line on the 4-hours chart.

- The US New Home Sales declined 12.8% in July 2019 (MoM), whereas the forecast was -0.2%.

- The German IFO Business Climate Index could drop from 95.7 to 95.1 in August 2019.

EUR/USD Technical Analysis

This past week, the Euro extended its decline below the 1.1100 support against the US Dollar. The EUR/USD pair traded as low as 1.1051 and recently started an upside correction.

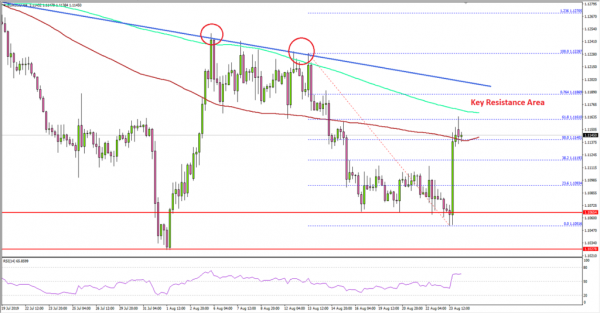

Looking at the 4-hours chart, the pair bounced nicely above 1.1100 plus the 50% Fib retracement level of the downward move from the 1.1228 high to 1.1051 low.

The pair even climbed a few pips above the 1.1140 level and the 100 simple moving average (red, 4-hours). However, there are many important resistances on the upside near the 1.1180 and 1.1200 levels.

Moreover, there is a key bearish trend line forming with resistance near 1.1195 level on the same chart. Therefore, any further gains in EUR/USD could face a strong selling interest near the 200 simple moving average (green, 4-hours), 1.1180, 1.1190 and 1.1200.

If there is a successful close above 1.1200, the pair could climb towards the 1.1240 and 1.1250 resistance levels. Conversely, if the pair fails to continue higher, it could resume its decline.

An immediate support is near the 1.1110 and 1.1100 levels. Any further losses may perhaps lead the pair towards the 1.1050 swing low in the near term.

Fundamentally, the US New Home Sales report for July 2019 was released by the US Census Bureau. The market was looking for a 0.2% decline in sales compared with the previous month.

The actual result was disappointing, as there was a 12.8% decline in the sales. On the other hand, the last reading was revised up from 7.8% to 20.9%.

The report added:

Sales of new single‐family houses in July 2019 were at a seasonally adjusted annual rate of 635,000. This is 12.8 percent (±16.2 percent) below the revised June rate of 728,000, but is 4.3 percent (±14.0 percent) above the July 2018 estimate of 609,000.

Overall, EUR/USD is likely to struggle near the 1.1180 and 1.1200 resistance levels in the coming sessions. On the other hand, GBP/USD climbed higher nicely and broke the key 1.2200 resistance area.

Upcoming Economic Releases

- German IFO Business Climate Index for August 2019 – Forecast 95.1, versus 95.7 previous.

- German IFO Current Assessment Index August 2019 – Forecast 98.6, versus 99.4 previous.

- Chicago Fed National Activity Index for July 2019 – Forecast 0.02, versus -0.02 previous.

- US Durable Goods Orders for July 2019 – Forecast +1.1% versus +1.9% previous.