Key Highlights

- The British Pound declined below the key 1.2150 support area against the US Dollar.

- GBP/USD traded below a major bullish trend line with support at 1.2175 on the 4-hours chart.

- The UK Manufacturing PMI declined from 48.0 to 47.4 in August 2019.

- UK’s Construction PMI could increase from 45.3 to 45.9 in August 2019.

GBP/USD Technical Analysis

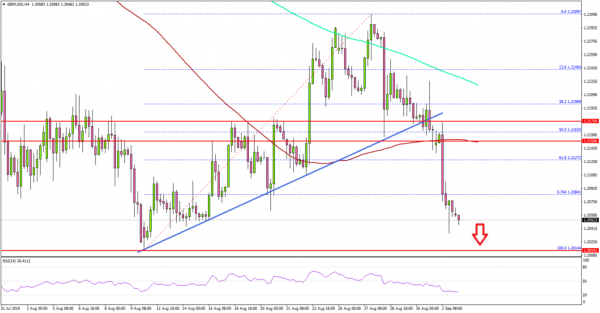

After a decent upward move, the British Pound struggled near 1.2310 against the US Dollar. As a result, the GBP/USD pair started a fresh decline and broke many key supports, such as 1.2250, 1.2200 and 1.2150.

Looking at the 4-hours chart, the bulls fought to prevent a downside break below the 1.2175 and 1.2150 support levels. However, they failed to protect additional losses, resulting in a bearish break below 1.2175.

The pair traded below a major bullish trend line with support at 1.2175 and later broke the main 1.2150 support area. Moreover, there was a break below the 61.8% Fib retracement level of the upward move from the 1.2014 low to 1.2309 high.

It opened the doors for more downsides below the 1.2100 level. The pair is now trading below 1.2080 plus the 76.4% Fib retracement level of the upward move from the 1.2014 low to 1.2309 high.

Therefore, there is a risk of additional downsides towards the 1.2014 low. In the mentioned case, GBP/USD could even decline below the 1.2014 low and the 1.2000 support.

On the upside, the previous supports near 1.2150 and 1.2175 are likely to act as resistances along with the 100 simple moving average (red, 4-hours).

Fundamentally, the UK Manufacturing Purchasing Managers Index (PMI) for August 2019 was released by both the Chartered Institute of Purchasing & Supply and the Markit Economics. The market was looking for a minor rise from the last reading of 48.0 to 48.4.

The actual result was lower than the forecast, as the UK Manufacturing PMI declined to 47.4 in August 2019. It seems like the ongoing economic and political uncertainty pervasive across domestic and global markets weighed massively on the performance of UK manufacturing.

The report added:

Output volumes fell as intakes of new work contracted at the fastest pace for over seven years, while business optimism dropped to a series-record low.

To sum up, GBP/USD remains at a risk of more downsides below 1.2010 and 1.2000. Similarly, EUR/USD is declining and it could decline further towards 1.0910.

Upcoming Economic Releases

- UK’s Construction PMI for August 2019 – Forecast 45.9, versus 45.3 previous.

- US Manufacturing PMI for August 2019 – Forecast 49.9, versus 49.9 previous.

- US ISM Manufacturing Index for August 2019 – Forecast 51.0, versus 51.2 previous.