Key Highlights

- The US Dollar started a fresh decline from the 108.50 resistance against the Japanese Yen.

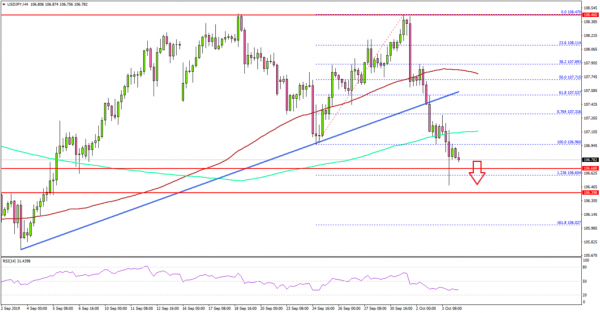

- USD/JPY traded below a bullish trend line with support near 107.45 on the 4-hours chart.

- The US ISM Non-Manufacturing Index declined sharply from 56.4 to 52.6 in Sep 2019.

- The US nonfarm payrolls could increase 145K in Sep 2019, better than the last 130K.

USD/JPY Technical Analysis

The US Dollar failed twice to clear the 108.50 resistance area against the Japanese Yen. As a result, USD/JPY started a fresh decline and broke the key 107.50 support area.

Looking at the 4-hours chart, the pair formed a double top pattern near the 108.50 resistance area before starting the recent decline. During the decline, there was a break below many supports and the 100 simple moving average (red, 4-hours).

Moreover, the pair traded below a bullish trend line with support near 107.45 on the same chart. The decline was such that the pair broke the last swing low near the 106.95 level.

Therefore, there are chances of more losses below the 106.80 level. The next support is near the 106.60 level since it represents the 1.236 Fib extension level of the upward move from the 106.96 swing low to 108.47 high.

If there are more downsides, the pair could test the 106.40 or 106.25 support. Conversely, if there is an upward move, the previous support near 107.50 might prevent further gains. The main resistance on the upside is now near 107.80 and the 100 SMA.

Fundamentally, the US ISM Non-Manufacturing Index for Sep 2019 was released by the Institute for Supply Management (ISM). The market was looking for a decrease from 56.4 to 55.0.

The actual result was disappointing, as the US ISM Non-Manufacturing Index declined sharply from 56.4 to 52.6 in Sep 2019, and just managed to register expansion. This points to continued growth in the non-manufacturing sector, at a slower rate.

The report added:

Manufacturing Business Activity Index decreased to 55.2 percent, 6.3 percentage points lower than the August reading of 61.5 percent, reflecting growth for the 122nd consecutive month. The New Orders Index registered 53.7 percent; 6.6 percentage points lower than the reading of 60.3 percent in August.

Overall, USD/JPY remains at a risk of more downsides below 106.80 and 106.60. Conversely, there was a minor recovery initiated in EUR/USD and GBP/USD in the past few sessions.

Upcoming Economic Releases

- US nonfarm payrolls Sep 2019 – Forecast 145K, versus 130K previous.

- US Unemployment Rate Sep 2019 – Forecast 3.7%, versus 3.7% previous.