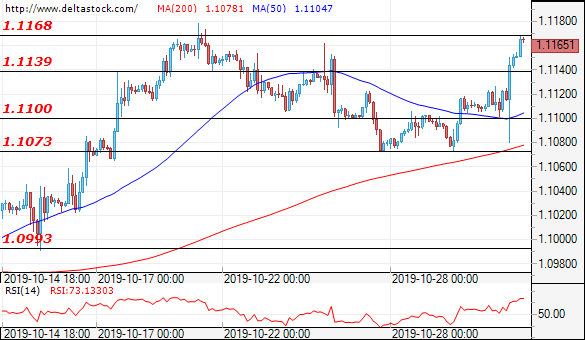

EUR/USD

Current level – 1.1165

Yesterday’s depreciation of the greenback after FED’s decision to lower interest rates and the guidance provided during Powell’s press conference, helped bulls to push through the resistance at around 1.1140. The EUR/USD is currently preparing to test the important 1.1168 level and, if successful, the bullish scenario for a move towards 1.1240 remains probable. In the opposite direction the nearest support levels are at 1.1140 and 1.1100.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1168 | 1.1240 | 1.1139 | 1.1073 |

| 1.1240 | 1.1270 | 1.1100 | 1.0960 |

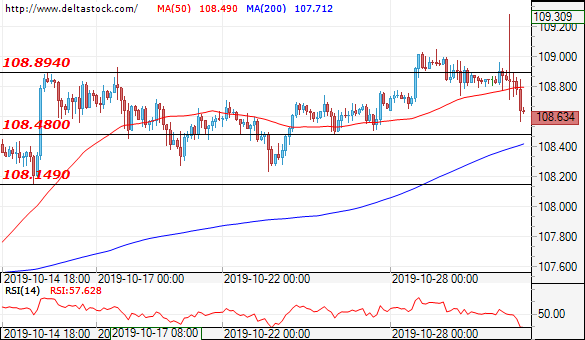

USD/JPY

Current level – 108.63

The currency pair made a second unsuccessful attempt to breach the important resistance at 108.90. In case it stays above the support at 108.48, another attempt at 108.90 could be expected. An eventual break of the aforementioned should lead to a continuation of the move up.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 109.30 | 109.70 | 108.50 | 107.85 |

| 109.70 | 110.00 | 108.15 | 107.00 |

GBP/USD

Current level – 1.2922

After the British parliament gave the green light for new general elections to be held on December 12 and the greenback depreciated, the Cable gained momentum and continued its push to the upside. At the moment the more likely scenario for the GBP/USD is the bullish one. A test of the important resistance at 1.3000 remains probable and, if broken, should draw an even more bullish picture. First support lies at 1.2843 in case of a stronger corrective move.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.2945 | 1.3180 | 1.2780 | 1.2560 |

| 1.2990 | 1.3300 | 1.2700 | 1.2400 |